Advertisement|Remove ads.

DraftKings Could Enter Prediction Markets, Says Jefferies — Retail Bulls Back It Up

DraftKings (DKNG) is likely to follow Flutter Entertainment’s (FLUT) lead into the prediction market space, according to Jefferies. However, the firm noted that the company could take a different route if it acquires Railbird, a New York-based technology company that operates a federally regulated prediction market and event contract exchange.

Jefferies maintained a ‘Buy’ rating on DraftKings with a $54 price target, according to The Fly. On Wednesday, CME Group (CME) and FanDuel, an online gaming company, part of Flutter Entertainment, announced that they will launch new products and expand access to financial markets for millions of FanDuel customers in the United States.

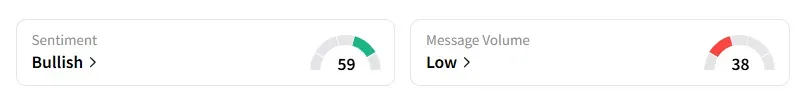

Retail sentiment on DraftKings remained unchanged in the ‘bullish’ territory, with chatter at ‘low’ levels, according to data from Stocktwits. Shares of the company were up nearly 1% at $45.96 during midday trading on Thursday.

Shares of DraftKings were up nearly 1% at $45.96 during midday trading on Thursday. A bullish user on Stocktwits noted that the stock could hit $50 to $60.

Jefferies, citing industry sources, said Flutters' partnership with CME Group is well thought out, with the company avoiding the need to acquire a "costly" designated contract market and legal conflicts of Kalshi.

Expected to launch later this year, the partnership will have products that will include benchmarks such as the S&P 500 and Nasdaq-100, prices of oil and gas, gold, cryptocurrencies, and key economic indicators such as GDP and CPI.

Jefferies noted that despite the "potential allure" of prediction markets, it still has reservations about the space for now, citing the potential impact on its state regulator relations.

Another bullish user on Stocktwits noted that there’s a chance of a prediction announcement by the end of August.

DraftKings stock has gained 24% this year and jumped over 30% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)