Advertisement|Remove ads.

Wall Street’s Top Loser Today Stays In Retail’s Good Books: Stocktwits Extremely Bullish On FDMT

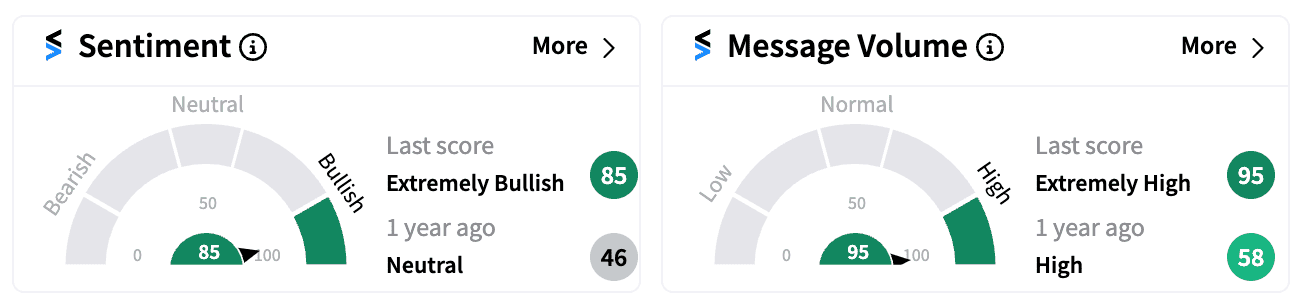

Shares of 4D Molecular Therapeutics Inc. (FDMT) plummeted over 35% to $17.30 by Wednesday afternoon, marking it as the top loser among U.S. stocks. Surprisingly, retail traders remain highly bullish on the stock, with Stocktwits sentiment extremely bullish (85/100) amid extremely high message volumes (95/100).

Initially, FDMT shares climbed following the release of encouraging mid-stage clinical study results for its 4D-150 gene therapy, aimed at treating wet age-related macular degeneration (wAMD), a chronic eye disorder that leads to blurred vision or blind spots in central vision.

However, the broader market turned its focus to various downside risks, including safety concerns raised by RBC Capital. While the firm maintains 4D-150 is "best in class," it flagged a "safety blip" – one case of inflammation in a patient with a history of syphilis, Investing.com reported. BMO Capital lowering the price target further may have added to the pressure.

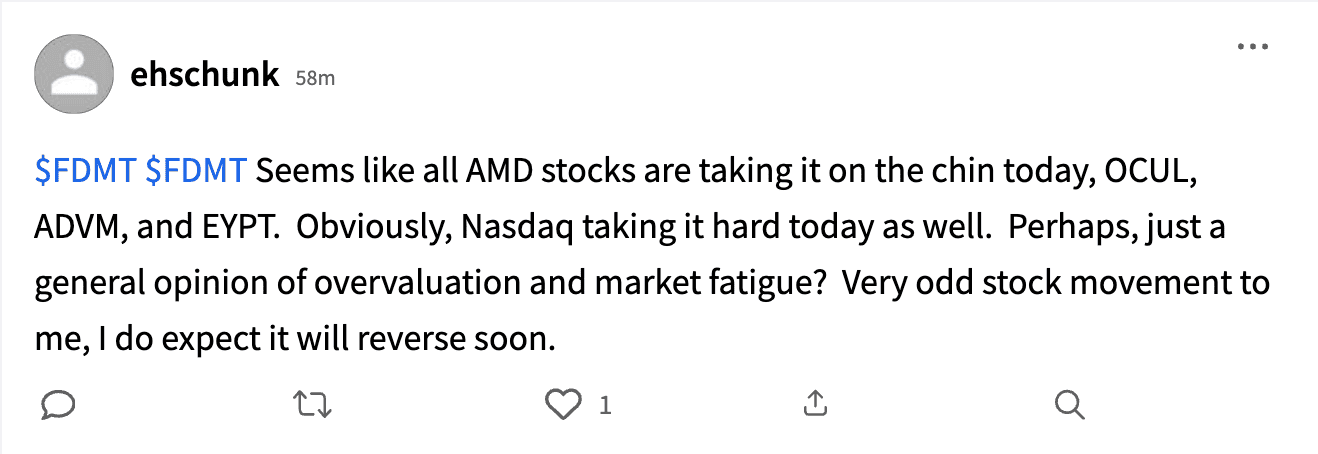

Despite the sell-off, retail investors on Stocktwits seem to view Wednesday’s crash as a buying opportunity. One user noted that 4D’s peers, Ocular Therapeutix Inc. (OCUL), Adverum Biotechnologies Inc (ADVM) and EyePoint Pharmaceuticals Inc. (EYPT), “are taking it on the chin today.”

“Obviously, Nasdaq taking it hard today as well. Perhaps, just a general opinion of overvaluation and market fatigue? Very odd stock movement to me, I do expect it will reverse soon,” said Stocktwits user ‘ehschunk’.

The overall market sentiment didn’t help, as U.S. stocks pulled back from their all-time highs on Wednesday, impacted by falling chip and tech stocks, though the Dow Jones managed its sixth consecutive day of gains.

FDMT shares are down over 19% year-to-date, contrasting with OCUL’s impressive 65% rise. EYPT has had an even tougher year, losing 57% so far, while ADVM has lost only 0.18%.

However, FDMT’s consistent performance in beating EPS estimates for the past four quarters provides some relief and hope for a rebound among its retail investors.

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)