Advertisement|Remove ads.

Ford, Nissan Adjust Strategies In Response To Trump Auto Tariffs: Retail Sentiment Mixed

President Donald Trump's tariffs on imported vehicles took effect two weeks ago, with an additional 25% duty on auto parts expected next month.

While he has hinted at a pause to support U.S. firms, some auto giants are already adjusting strategies to cushion the impact.

Ford has told dealers it could increase prices on newly built vehicles starting in May if Trump does not ease tariffs on auto imports.

The news comes from a memo reviewed by Reuters and Automotive News, written by a top Ford executive.

Dearborn, Michigan-based Ford will not bump sticker prices on any vehicles currently in inventory at dealerships.

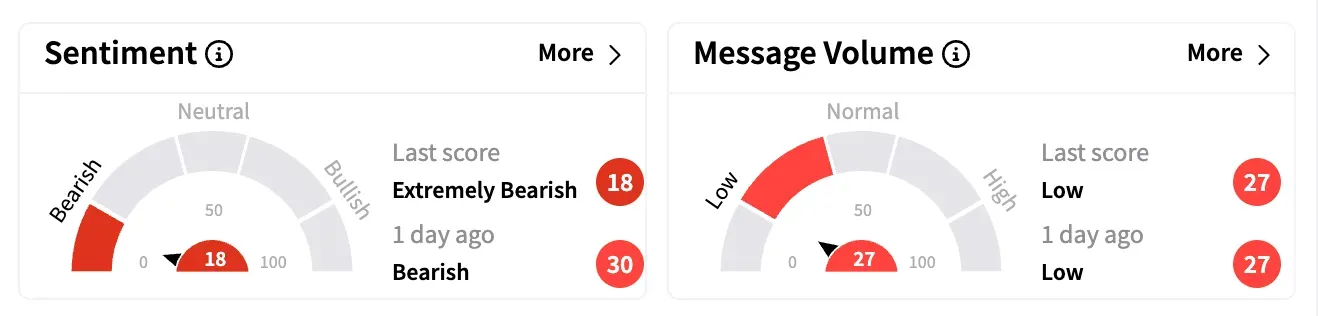

On Stocktwits, sentiment for Ford dipped into 'extremely bearish' levels by late Wednesday, accompanied by a drop in message volume, suggesting retail investor wariness for the stock amid macroeconomic uncertainty.

Several users noted that their put options on the stock were "printing."

Ford's stock climbed after the bell but is down over 5% this year.

Meanwhile, Nissan's Americas chairman, Christian Meunier, told CNBC the Japanese giant plans to "max out" output at its largest U.S. plant in Smyrna, Tennessee.

The 6-million-square-foot facility reportedly churned out over 314,500 vehicles last year.

"We're looking into selling more of the U.S. products, and adjusting, along the way, vehicles that are coming from Mexico and from Japan," Meunier said.

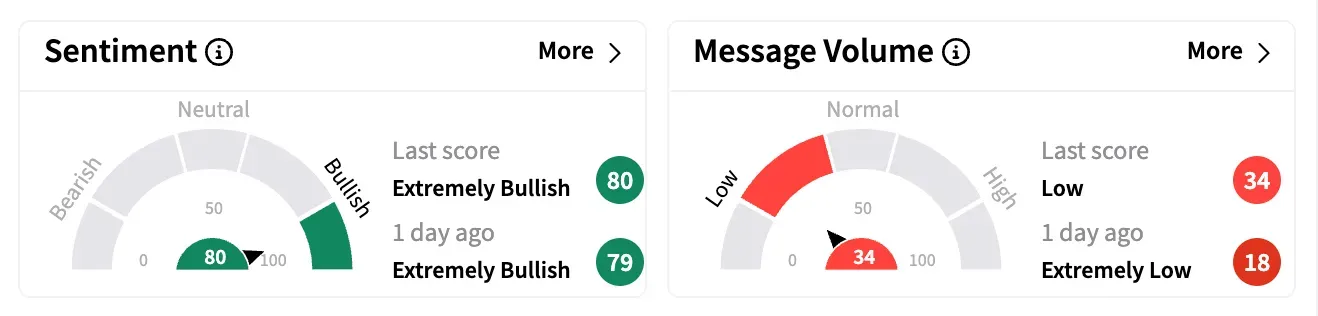

Stocktwits sentiment for Nissan ended on an 'extremely bullish' note late Wednesday amid a slight uptick in message volume.

Nissan recently named a new CEO following a failed merger attempt with Honda. The incoming leadership says it plans to cut vehicle development time to sharpen the company's competitive edge.

The company's stock trades over the counter in the U.S. and has shed nearly 30% this year.

Earlier this week, Wedbush Securities told clients that flipping a decades-old global auto supply chain cannot happen overnight. Analysts argued the smarter approach would be to focus on boosting U.S.-made finished vehicles rather than targeting auto parts with tariffs.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)