Advertisement|Remove ads.

Glucotrack Stock Just Rose Over 123% Today: Here’s An Important Update

Glucotrack Inc. (GCTK), a medical technology company specializing in diabetes management solutions, attracted significant investor interest after its shares rose by over 144% on Friday afternoon.

On Thursday, the company announced a new financing arrangement with Sixth Borough Capital Fund LP. This agreement could provide the company with up to $20 million in equity capital over the next two years, depending on various regulatory and market conditions.

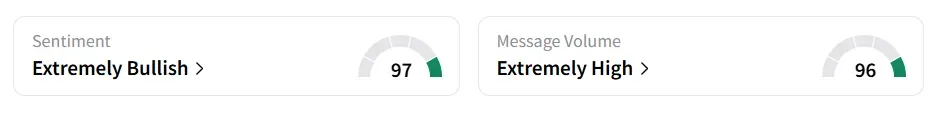

On Stocktwits, retail sentiment around Glucotrack stock jumped to ‘extremely bullish’ from ‘bearish’ territory the previous day. Message volume levels also shifted to ‘extremely high’ from ‘low’ levels in the last 24 hours.

The stock experienced a 1,800% surge in user message count as of Friday morning. Stocktwits users commended the investment move.

The deal includes a purchase agreement and a related registration rights agreement. The agreement grants Glucotrack the right, but not the obligation, to issue and sell shares of its common stock valued at up to $20 million. This offering can be executed incrementally, at the company's discretion, within a 24-month window following the commencement date.

This financing vehicle provides Glucotrack with a flexible means to raise capital when needed, enabling it to support product development, commercialization, or general operations.

For the second quarter, the company’s net loss increased to $4.75 million, compared to a loss of $4.48 million in the same period last year. Cash and equivalents as of June 30 totaled $9.5 million.

Glucotrack stock has lost over 97% of its value year-to-date and 99% in the last 12 months.

Also See: Opendoor Chairman Keith Rabois Plans Massive Layoffs: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)