Advertisement|Remove ads.

Godawari Power Hits Fresh 52-Week High – SEBI Analyst Sees Room For Further Rally

Godawari Power & Ispat (GPIL) shares have been in an uptrend, and have hit a fresh 52-week high on Monday, rising nearly 10%. In the last month, GPIL has gained over 30%, driven by strong technicals and fundamental strength.

Over the last six months, Godawari Power has seen a stellar 60% rally. It was among the breakout stocks to watch for September, flagged by SEBI analysts on Stocktwits. And it was among the 'top trending' stocks on the platform at the time of writing.

Technical Outlook

SEBI-registered analyst Financial Sarthis has flagged a weekly breakout pattern in GPIL stock above a prolonged consolidation phase, with the Fibonacci extension levels serving as indicators for the next potential targets.

Financial Sarthis identified next resistance levels at ₹268, ₹300, ₹318, and ₹343 for Godawari Power. They added that the rally led by strong volumes confirms momentum on its technical charts. On the downside, support is seen at ₹242-₹245.

If the stock maintains this upside run, it could potentially test ₹300 and higher, according to them.

Fundamental Strength

The company has logged a net profit CAGR (Compound Annual Growth Rate) of 45% over the last five years. Additionally, its low debt profile adds to investor interest in this multibagger stock.

What Is The Retail Mood?

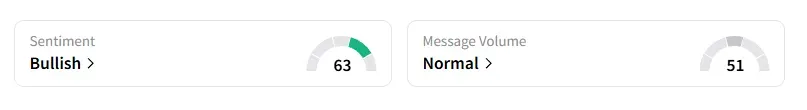

Data on Stocktwits shows that retail sentiment moved from ‘neutral’ to ‘bullish’ a day ago amid ‘normal’ message volumes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_Social_logo_1200_Px_resized_jpg_86883cac04.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227049575_jpg_fe5b82901f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_AI_OG_jpg_872671f607.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)