Advertisement|Remove ads.

Pre-Market Trends: Greenlane, ConnectM, PS International Stocks Grab Most New Retail Watchers

U.S. stock index futures displayed indecision on Tuesday, following a flat close the previous day. Investors are awaiting crucial inflation data later this week, which could significantly impact the Federal Reserve's monetary policy stance. Amidst this, retail investor following surged the most over the past 24 hours for the following three stocks:

Greenlane Holdings Inc. (GNLN): The cannabis accessories and vaporization product distributor’s stock witnessed a bit of profit-booking in pre-market trading after a staggering 365% surge the previous day. The move was driven by its agreement to exclusively distribute Safety Strips, Inc.'s fentanyl, xylazine, and drink spike detection test strips in the U.S.

This development gains significance in light of the DEA's recent warning about the deadly combination of fentanyl and xylazine being found in nearly a quarter of drugs sampled from 48 out of 50 U.S. states.

However, Greenlane’s float is less than 530,000 shares, with a short interest of 18.7%, and likely contributes to the stock's volatile price movement.

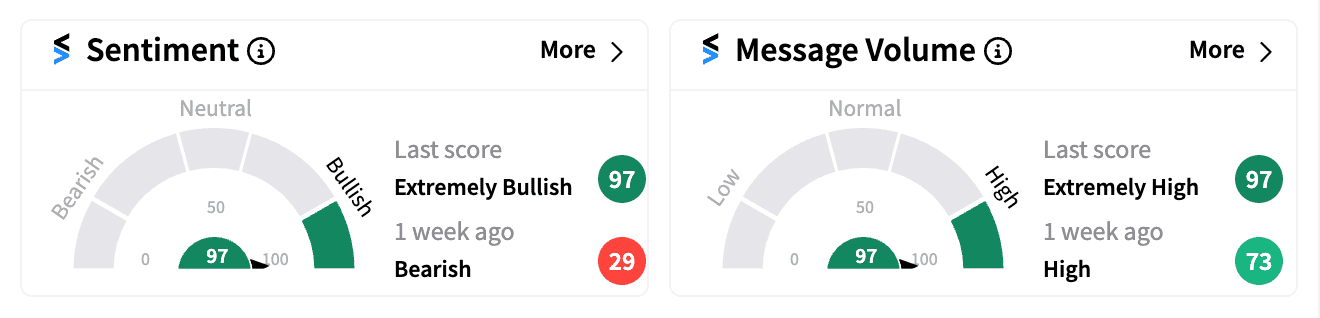

Retail sentiment on Stocktwits was ‘extremely bullish’ (97/100), matching the year's high seen in April.

ConnectM Technology Solutions Inc. (CNTM): Shares of the company specializing in electrification and AI technology continued their upward trajectory in pre-market trading following a 43% gain the previous day.

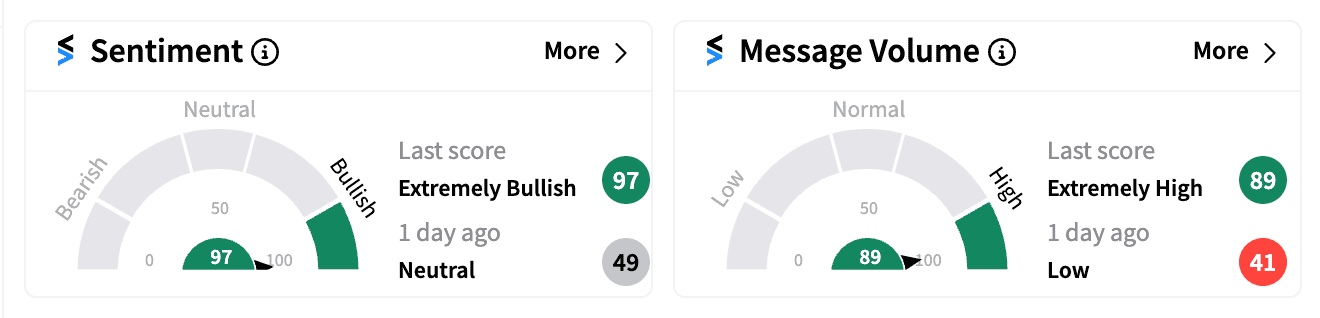

Retail sentiment on Stocktwits soared from ‘neutral’ to ‘extremely bullish’ (97/100), hitting a lifetime high. Pre-market volume nearly doubled the daily average.

The company on Monday published its Electrification Impact Scorecard for the first half of 2024, which showed that ConnectM raised electrification by 87 GWh (200%), sequestered 61,584 metric tons of CO2 (273%), and displaced 6.6 million gallons of fossil fuel (295%).

The firm earlier this month also expanded into last-mile delivery through the acquisition of DeliveryCircle.

PS International Group Ltd. (PSIG): Shares of the freight forwarding service company surged over 127% on Monday, pushing it into the top gainers list, without a clear catalyst. Following the rise, some amount of profit-booking led to a 12.61% correction in pre-market trading on Tuesday.

Retail investors on Stocktwits noted similarities to ConnectM's price action. Pre-market volume was 1.78 times the daily average.

With a short interest of 36%, PSIG's surge echoes the "meme stock" frenzy seen earlier this year.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)