Advertisement|Remove ads.

Hershey Highlights Plans To Address Commodity Inflation: CFO Remains ‘Hopeful That Tariffs On Our Largest Exposure Will Improve’

Hershey (HSY) CEO Michele Buck said on Wednesday the chocolate maker has implemented plans to address the commodity inflation it has absorbed over the past two years, and announced a new price action this month on the entirety of its U.S. confectionery portfolio.

“These products represent roughly 80% of total net sales, and through a combination of list price and price pack architecture, we will deliver an estimated 16 points of pricing contribution to the overall company,” Buck said in the company’s prepared remarks.

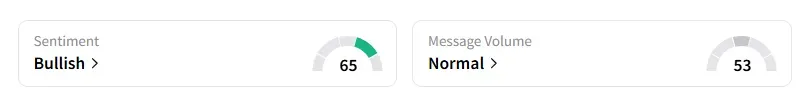

Retail sentiment on Hershey remained in the ‘bullish’ territory, with chatter levels improving to ‘normal’ from ‘low,’ according to Stocktwits data.

Shares of Hershey were up about 2% during midday trading after it beat second-quarter sales and profit expectations, driven by steady demand during the Easter season.

However, the tariff expense, depending on current levels, would be approximately $170 million to $180 million for the full year 2025.

“Given the unique circumstances surrounding cocoa, which cannot be grown in the United States, we remain hopeful that tariffs on our largest exposure will improve as trade negotiations continue, though this will likely take time,” CFO Steve Voskuil said.

“We are not planning for relief in 2025 and have fully embedded these incremental costs in our full-year outlook,” Voskuil added.

Hershey now expects full-year adjusted earnings per share (EPS) to decline between 36% and 38%, compared with the prior forecast of down in the mid-30% range.

Its second-quarter net sales came in at $2.61 billion, compared with Wall Street estimates of $2.52 billion, according to data compiled by Fiscal AI. Hershey’s adjusted EPS was $1.21, beating estimates of $0.99.

The stock has jumped nearly 12% year-to-date but has fallen 4% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)