Advertisement|Remove ads.

Hilton Stock Drops After Q3 Revenue Miss, Weak Guidance: Retail Mood Crashes

Shares of Hilton Worldwide Holdings, Inc. ($HLT) fell nearly 3% on Wednesday after the hotel giant reported mixed quarterly results, dragging down retail investor sentiment.

Third-quarter revenue of $2.87 billion missed the $2.91 billion consensus forecast.

However, Hilton posted adjusted earnings of $1.92 per share, exceeding estimates by $0.07.

Despite the earnings beat, weak guidance for the current quarter weighed on investor sentiment.

For Q4, Hilton expects adjusted EPS between $1.57 and $1.67, below the consensus of $1.77, with system-wide comparable revenue per available room (RevPAR) forecast to rise just 1.0%-2.0% year-over-year.

The company also guided for Q4 adjusted EBITDA between $804 million and $834 million.

Full-year 2024 adjusted EPS is expected to range between $6.93 and $7.03, slightly under the $7.06 estimate, with RevPAR projected to increase 2.0%-2.5%.

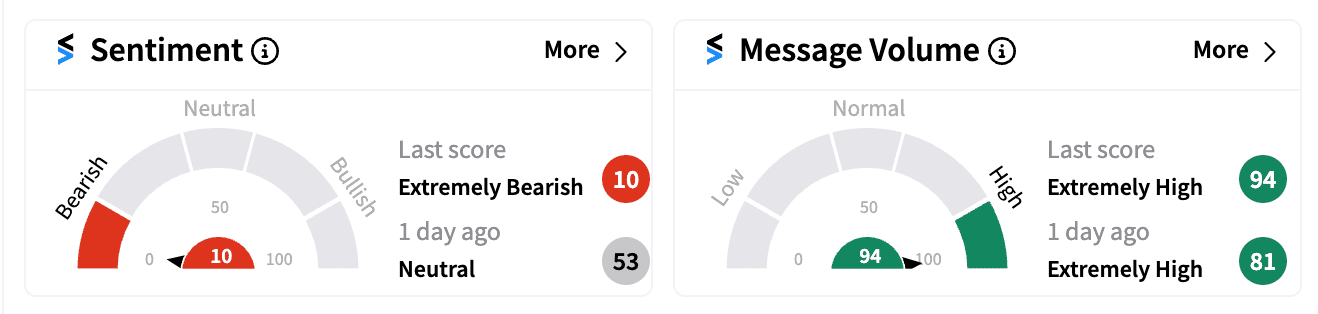

On Stocktwits, retail sentiment for HLT plummeted to an ‘extremely bearish’ (10/100) level, the lowest score of the year, amid heightened retail chatter following the earnings miss and guidance downgrade.

During the earnings call, Hilton highlighted plans for 6%-7% net unit growth in 2025 but cautioned that Q4 RevPAR growth could be partially offset by ongoing labor disputes and the U.S. election.

The Chris Nassetta-led company noted that 2025 is expected to mirror 2024 in terms of same-store growth.

Despite these challenges, Hilton has been actively expanding its pipeline with the acquisitions of NoMad and Graduate Hotels and partnerships with Small Luxury Hotels of the World and AutoCamp.

The company’s network growth comes at a time when financing new developments is increasingly difficult due to high interest rates.

While Hilton’s stock has risen nearly 30% this year amid recovering U.S. lodging demand, the company faced headwinds from hotel worker strikes in cities like Boston, Honolulu, and San Diego, along with the impact of Hurricane Helene on bookings.

For updates and corrections email newsroom@stocktwits.com

Read next: Zoomcar Creates Retail Ripples After Waze Co-Founder Returns As Advisor

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/04/rich-money-2025-04-f0b4073db42c6bc97979f963f46d5013.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/03/filter-coffee.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/metal-and-mining-2025-10-7f1cf8d6ed7a5d31e2971be9b93f8539.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/2025-10-24t181332z-2012779548-rc2hihawafmm-rtrmadp-3-grindr-m-a-2025-10-eb89b2d5d1b2c7ee27da768ccd3a2e66.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/jane-2-2025-10-0cb531b3a4a4595817838ded781057b1.jpg)