Advertisement|Remove ads.

ICICI Pru Life Stuck In A Range: Breakout Above ₹605 Key For Upside, Says SEBI Analyst

Shares of ICICI Prudential Life have been stuck in a narrow range between ₹595 and ₹605 for the past 10 days, indicating a lack of strong trend or momentum in either direction. Technical indicators have been showing mild bearishness.

Investors will be watching for commentary from the investor meet scheduled for September 19. The private life insurer had earlier postponed this analyst meeting.

SEBI-registered analyst Deepak Pal believes that a breakout above ₹605 could trigger a short-term upside for the stock. He recommended a buy-on-dips strategy for long-term investors but warned about high valuations and inconsistent operational performance.

Technical Watch

Technical indicators such as the Relative Strength Index (RSI) stands around 41, suggesting mild bearishness but not oversold conditions. Parabolic SAR dots remain above the price, showing ongoing downward pressure, while the MACD also remains weak, pointing to limited bullish momentum.

What Should Traders Do?

According to Pal, a close above ₹605 is required for confirmation of any breakout move; only then could a short-term target of ₹620 can be expected. Sustaining above ₹605–₹610 is crucial, preferably with supporting volume and improved market sentiment. But if ICICI Pru Life stock closes below ₹595, the next support is seen near ₹585, where buyers may re-emerge.

For long-term investors, Pal suggested buying on dips, backed by recent positive quarterly results and profit growth. On the upside, targets of ₹650–660 are likely, but the stock is underperforming its benchmark over the past year and is considered expensive based on its Price-to-Book Value (6.9x). He advised traders to watch for operational performance and growth challenges.

News Triggers

On September 12, the board approved the issuance of debentures, a call option, and changes to the directorship, following the recent announcement of employee stock option (ESOP) allotments.

The company had posted record net sales for the June quarter and a 34% jump in profit, though long-term sales growth and operational efficiency remain challenges.

Pal concluded that overall, the sentiment around ICICI Life Prudential remained neutral to slightly negative in the short term.

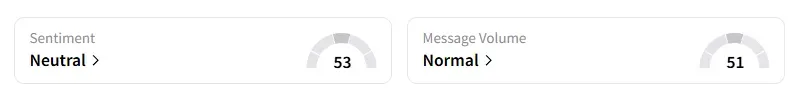

What Is The Retail Mood?

Data on Stocktwits showed that retail sentiment, too, has remained ‘neutral’ for over a week now.

ICICI Prudential Life shares have risen only 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)