Advertisement|Remove ads.

India Stock Market: Nifty, Sensex Inch Higher In Early Trading — Retail Stays Guarded On Lingering Tariff Concerns

Indian markets opened Wednesday on a tepid note, tracking weak global cues amid renewed trade tensions and investor caution over U.S. tariff developments.

The benchmark Nifty and Sensex rose more than 0.1% by 9:50 am in Mumbai trading, with the midcap and smallcap indices showing marginal strength.

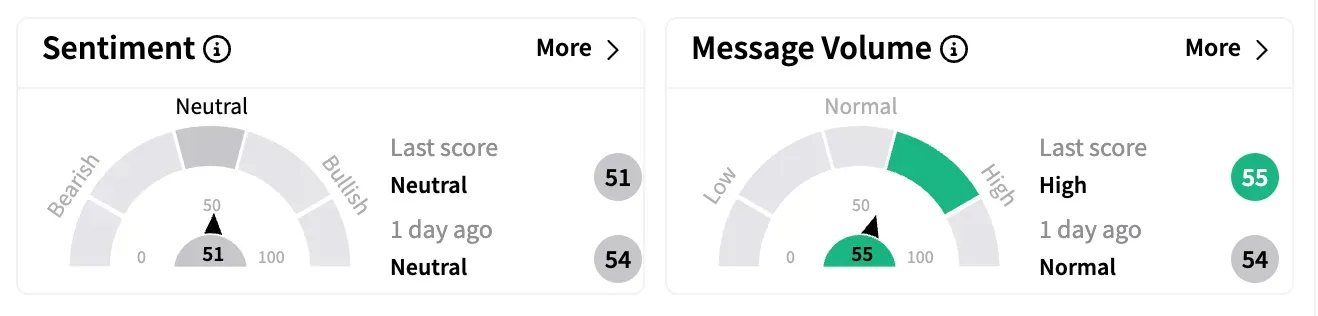

Data from Stocktwits shows sentiment around the Nifty 50 stayed 'neutral,' indicating retail investor caution amid an escalating Sino-U.S. trade war.

Asian stocks edged lower, while U.S. equity futures slipped as fresh American restrictions on Nvidia chip exports to China reignited fears of a prolonged tech trade conflict.

Investors are now eyeing U.S. Fed Chair Jerome Powell's remarks and updates on the ongoing chip trade tensions for cues.

Indian sectors were mixed. The Nifty IT and Nifty Auto were among the top losers, weighed down by global tariff tensions.

On the other hand, Bank Nifty, Nifty Private Bank, and Nifty PSU Bank continued their climb from the previous session, posting gains even as overall market sentiment remained subdued.

Gensol Engineering shares tumbled 5% early Wednesday after the markets regulator issued interim orders against the company and its promoters for alleged fund diversion and record falsifications.

IndusInd Bank gained over 1% despite flagging a ₹1,979 crore hit from discrepancies in its derivatives portfolio after market hours on Tuesday.

IREDA surged 7%, while ICICI Lombard fell nearly 4% on poor quarterly earnings.

Investors will also watch Wipro, which will report fourth-quarter earnings after the market closes.

SEBI-registered analyst A&Y Market Research shared their intraday outlook for Nifty and Bank Nifty on Stocktwits: the Nifty is expected to face resistance between 23,432 and 23,460, with support in the 23,235 to 23,210 zone; for Bank Nifty, resistance is seen in the 52,259 to 52,404 range, while support is expected between 51,792 and 51,905.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)