Advertisement|Remove ads.

Indian Markets Cool After A Four-Day Rally, Nifty Ends Above 25,500; Midcaps Shine

Indian equity markets took a breather, snapping a four-day winning streak, with the Nifty index ending above the 25,500 level.

The Sensex fell 452 points to close at 83,606, while the Nifty 50 fell 120 points to finish at 25,517.

Broader markets outperformed with the Nifty Midcap index gaining for the seventh straight session. The Midcap and Smallcap indices rose by over 0.5%.

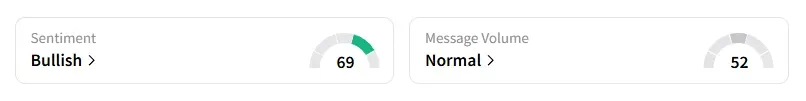

The retail investor sentiment surrounding the Nifty 50 remained ‘bullish’ on Stocktwits.

Sectorally, it was a mixed bag, with auto, FMCG, metals, and real estate stocks witnessing selling pressure. The PSU bank index rallied over 2%. This was after the Finance Ministry directed state-owned lenders to monetize their stakes in subsidiaries through IPOs or strategic stake sales.

Karnataka Bank ended 6% lower after the bank's CEO and Executive Director resigned from their positions, citing personal reasons.

IDBI Bank shares gained 2% on reports that the government is gearing up to invite financial bids for the lender.

IndusInd Bank also rose 2% on news reports that the lender has submitted a shortlist of three senior bankers to the Reserve Bank of India (RBI) for consideration as its next chief executive officer.

JB Pharma shares ended 7% lower after Torrent Pharma bought a 46.39% stake in the company from private equity giant KKR for ₹11,917 crore. They will also make an open offer to buy 26% more from public shareholders at ₹1,639.18 per share. JB Pharma slipped as investors priced in the 9% discount on the open offer, while Torrent rose 2% on the deal positives and aggressive consolidation.

Alembic Pharma surged 6% after it received USFDA approval for a key cancer drug. Timken rose 5% after it announced that commercial production has commenced at its new manufacturing facility in Bharuch.

Jyoti CNC ended 6% lower on the back of a large block deal. And Waaree Energies surged 7% on a fresh order win.

Raymond rallied 14% ahead of its real estate arm, Raymond Realty’s listing tomorrow.

Globally, European markets traded lower, and Dow Futures indicated a positive opening for Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lumen_technologies_logo_resized_jpg_29f9980341.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_logo_original_jpg_93ebf851f7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212184506_jpg_fda8936683.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Novo_Nordisk_jpg_96dd19f953.webp)