Advertisement|Remove ads.

Indian Pharma Stocks On The Edge: SEBI RA Vikash Bagaria Warns Of Breakdown In Dr Reddy’s Shares Amid US Policy Jitters

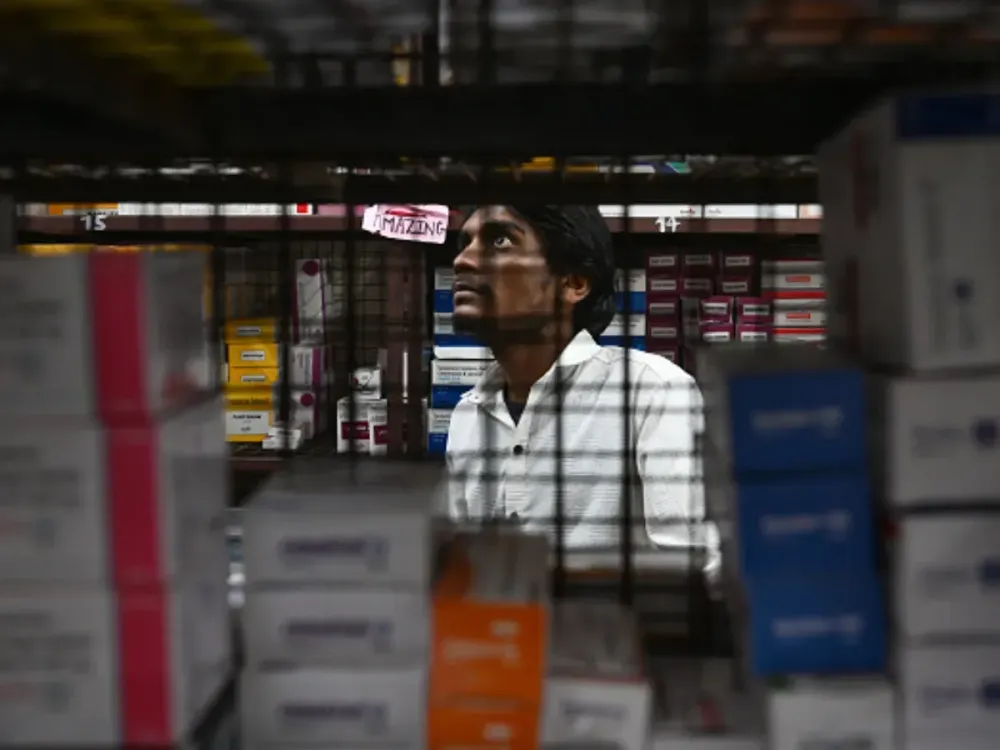

Indian pharmaceutical stocks are reeling from policy jitters after U.S. President Donald Trump signed an executive order on Monday aimed at ramping up domestic drug manufacturing — a move that threatens to undercut India’s highly export-driven pharma sector.

Trump's executive order signals a shift toward pharmaceutical self-sufficiency in the U.S., potentially reducing American demand for imported active pharmaceutical ingredients (APIs) and generic drugs — two key exports from India.

The immediate fallout is visible in market sentiment. Stocks such as Aurobindo Pharma, and Lupin — all with heavy revenue dependence on the U.S. — have shown signs of weakness.

According to SEBI-registered analyst Vikash Bagaria, pharma is entering a vulnerable zone. He advises short-term traders to stay cautious, as more downside could be in store.

He notes that this policy shift could trigger earnings downgrades and valuation cuts for Indian pharma giants that rely heavily on U.S. sales.

Among the most exposed companies are Aurobindo Pharma (with 50% revenue from the U.S.), Dr. Reddy’s (45%), and Lupin (40%). Even moderately exposed players like Sun Pharma and Cipla could face margin pressure.

Bagaria points to a number of technical red flags in Dr. Reddy’s Laboratories, a bellwether in the sector.

He observes that Dr. Reddy’s Laboratories is currently facing significant pressure near a major trendline resistance in the ₹1,175–1,180 range, with multiple failed attempts to break above this level, suggesting growing bearish momentum.

Bagaria cautions that a breakdown below ₹1,140 could trigger sharp selling, potentially driving the stock down toward ₹1,060 and later to ₹935.

He also highlights that Dr. Reddy’s remains vulnerable to further downside unless it can convincingly break above the ₹1,200 mark. If the ₹1,140 support fails, a selloff is likely.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)