Advertisement|Remove ads.

INMD Stock Jumped Nearly 13% Today – What’s Powering The Rally?

- The company went public in 2019 at a post-money valuation of $480 million, according to the report.

- InMode has been facing declining sales and profits since 2023.

- On January 9, the company said it anticipated its fourth-quarter sales to fall within a tight range of $103.6 million to $103.8 million.

InMode stock became the talk of the town on Monday after a report stated that the company is set to be acquired by an investment fund in a deal that values the firm at roughly $1.1 billion, marking a 25% premium over its current Nasdaq trading value of $882 million.

According to a Calcalist report, the transaction will result in InMode being taken private and removed from public trading.

InMode stock traded over 13% higher on Monday morning.

Background and Valuation

Founded in 2008 by Moshe Mizrahi, the firm's CEO, and Michael Kreindel, the firm's Chief Technology Officer, the company originally developed advanced minimally invasive aesthetic treatments using radio frequency (RF) technology. It went public in 2019 at a post-money valuation of $480 million and reached a peak market value of $7 billion in 2021.

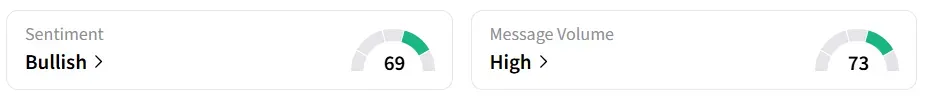

Following the report, retail sentiment around the stock jumped to ‘bullish’ from ‘neutral’ territory the previous day amid ‘high’ message volume levels on Stocktwits.

Financial Challenges

According to the report, InMode has been facing declining sales and profits since 2023, partly due to rising interest rates in the U.S. and an economic slowdown that affected financing for doctors purchasing its devices.

The U.S. Food and Drug Administration’s (FDA) warning last October about health problems linked to some radiofrequency (RF) microneedling devices in general affected the stock.

On January 9, the company said it anticipated its fourth-quarter (Q4) sales to fall within a tight range of $103.6 million to $103.8 million, below the analysts' consensus estimate of $104.64 million, according to FiscalAI data. Furthermore, the company’s 2025 revenue outlook of $370.2 million to $370.4 million is also below the analysts' consensus estimate of $371 million.

INMD stock has declined by over 8% in the last 12 months.

Also See: CRWV Stock Soars 10% Pre-Market As Nvidia Invests $2B To Expand AI Factory Network

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_eli_lilly_logo_resized_9e8a8a2333.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_celsiusholdings_resized_jpg_5617397fa8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ethereum_OG_jpg_d3e6e5843b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)