Advertisement|Remove ads.

Intuit Stock Surges Post Strong Q3, Wall Street Lifts Price Target: Retail’s Exuberant

Shares of software company Intuit Inc. (INTU) surged 8.5% in Friday’s premarket session after reporting better-than-expected third-quarter (Q3) earnings.

The financial software provider’s Q3 revenue climbed 15% year-on-year (YoY) to $7.75 billion, beating the analyst consensus estimate of $7.56 billion, as per Finchat data.

The adjusted earnings per share (EPS) of $11.65 surpassed the consensus estimate of $10.91.

Following the earnings, Wall Street analysts raised their price targets and professed their confidence in the company’s performance.

Barclays increased its price target for Intuit to $815, up from $775, while maintaining an ‘Overweight’ rating on the stock.

According to a research note shared with investors, the brokerage pointed to strong fiscal third-quarter results, driven by sturdy performances in both Credit Karma and the Consumer segment.

Barclays added that, with the tax segment stabilizing, it has greater confidence in Intuit's overall business strength.

Stifel raised the price target to $850 from $725 while reiterating a ‘Buy’ rating on the stock.

The results suggest ongoing market share growth in the assisted tax segment, a trend Stifel anticipates will persist in the near future.

Additionally, Stifel noted continued strength in the Global Business Solution (GBS) segment, excluding Mailchimp, which will support sustained total revenue growth in the low teens over the short term.

Piper Sandler increased the price target to $825 from $785 and maintained an ‘Overweight’ rating on the stock.

The research firm pointed out the company's ongoing advancements in using AI and automation to deliver "done-for-you experiences."

As a result, Intuit anticipates TurboTax Live customer growth of 24% for the year and a 47% increase in annual revenue for the service, driven in part by an AI-enhanced user interface.

Wells Fargo, Citi, JP Morgan, Jefferies, and KeyBanc also raised their price targets on Intuit stock.

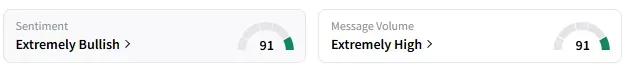

On Stocktwits, retail sentiment around Intuit remained in ‘extremely bullish’ territory.

Intuit stock has gained nearly 6% year-to-date and 0.6% in the last 12 months.

Also See: Apple Retail Traders Lose Faith As Market-Cap Trails Microsoft, Nvidia Amid 7-Day Losing Streak

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)