Advertisement|Remove ads.

Jio Financial Eyes Breakout: SEBI RA Sees Strong Uptrend, Warns Of Near-Term Pause

Jio Financial Services continues its upmove, rising nearly 3% on Thursday, to become the top Nifty gainer in early trade. The company announced that it had infused ₹190 crore in its payments bank subsidiary, Jio Payments Bank. It subscribed to 190 million equity shares at ₹10 each.

Last week, Jio Financial had acquired State Bank of India’s (SBI) entire 17.8% stake in Jio Payments Bank for ₹104.54 crore.

Jio Financial stock has risen over 8% in the last one week.

SEBI-registered firm Financial Independence observed that the stock has steadily gained from sub-₹200 levels in recent months and is now knocking on the door of a potential breakout zone near previous highs.

On technicals, the structure remains decisively bullish with consistent higher highs and higher lows.

They add that strong buying volumes and the Relative Strength Index (RSI) at 70.64 confirm the momentum, though the overbought zone is now approaching, and hence the stock is likely to see a a pause or profit-booking in the short-term.

A clean breakout above ₹315–₹318 could push the stock toward ₹330–₹345 levels, according to Financial Independence. However, they see ₹285-280 acting as a strong support and suggested that it can be used as a trailing stop zone.

They highlighted that Thursday’s breakout candle with good volume validates bullish strength in Jio Financial. This is an ideal opportunity for momentum traders, while investors may watch for an entry on consolidation.

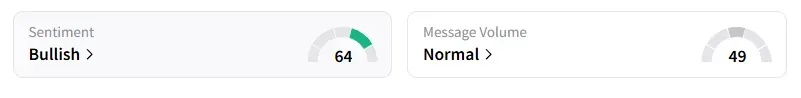

Data on Stocktwits shows that retail sentiment has been ‘bullish’ on this counter for a week.

Jio Financial shares have risen 4% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)