Advertisement|Remove ads.

Kotak Bank Shares Fall 5% After Q4 Earnings; SEBI RA Prameela B Eyes ₹2,300 As Breakout Level

Kotak Mahindra Bank’s stock fell over 5% on Monday, following a mixed earnings report that revealed underlying pressures in its core lending segments.

A major concern flagged by brokerages is the private lender’s weak operational performance in its rural and microfinance portfolio. As well as the compression in its net interest margin (NIM) which came in at 5.28%, down from 5.47%.

Kotak’s loan growth of 14% was led by the retail segment, but concerns remain around sustainability given the soft commentary on rural credit.

Kotak Bank's Q4 results, according to Prameela Balakkala, reveal a cautious stance due to increased provisions, which has affected profitability. Although there was a marginal improvement in asset quality, the decline in NIM and higher provisioning suggest ongoing margin pressures.

On the technical front, she identifies ₹2,300 as a critical make-or-break level, marked by heavy call writing and institutional supply.

Despite this, the stock continues to trade above key short-term moving averages, indicating that bullish sentiment has not dissipated yet.

She believes that unless there is a confirmed breakout, the prudent strategy would be to consider buying dips near ₹1,800–₹1,700, but only with clear reversal signals.

Balakkala adds that a sustained move above ₹2,300 could unlock a fresh rally, supported by institutional flows and sector rotation. Until such confirmation emerges, she recommends a cautious approach on the stock.

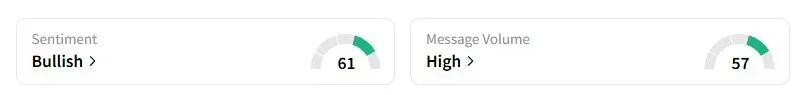

However, data on Stocktwits also shows that retail sentiment on this counter remains ‘bullish.’

Kotak Bank shares gained 16% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)