Advertisement|Remove ads.

Kraft Heinz Stock Slides On Q4 Revenue Miss, 2025 Outlook, But Retail’s Upbeat

Shares of The Kraft Heinz Co. ($KHC) fell more than 3% on Wednesday after its Q4 revenue and 2025 EPS outlook fell short of Wall Street estimates, but retail sentiment remained optimistic.

Kraft Heinz’ Q4 earnings per share of $0.84 exceeded the consensus estimates of $0.78, while revenues stood at $6.58 billion, missing estimates of $6.65 billion.

Q4 net sales decreased 4.1%, driven by a negative 0.8 percentage point impact from foreign currency, and a negative 0.2 percentage point impact from divestitures. The company also noted price increases of 1.0 percentage points versus the prior year period, driven by increases in the North America and Emerging Markets segments, with flat pricing in its international developed markets

“Although 2024 was a challenging year with our top-line results coming in below our expectations, we remained disciplined in protecting profitability while driving industry-leading margins, generating strong cash flow, and returning $2.7 billion in capital to stockholders,” said Kraft Heinz CEO Carlos Abrams-Rivera.

Kraft’s 2025 EPS outlook came below expectations. In 2025, Kraft expects adjusted EPS between $2.63 and $2.74, below the consensus estimates of $3.04.

For 2025, Kraft sees organic net sales flat to down 2.5% and adjusted operating income down 1%-4%; free cash flow is expected to stay the same in 2025, according to the company.

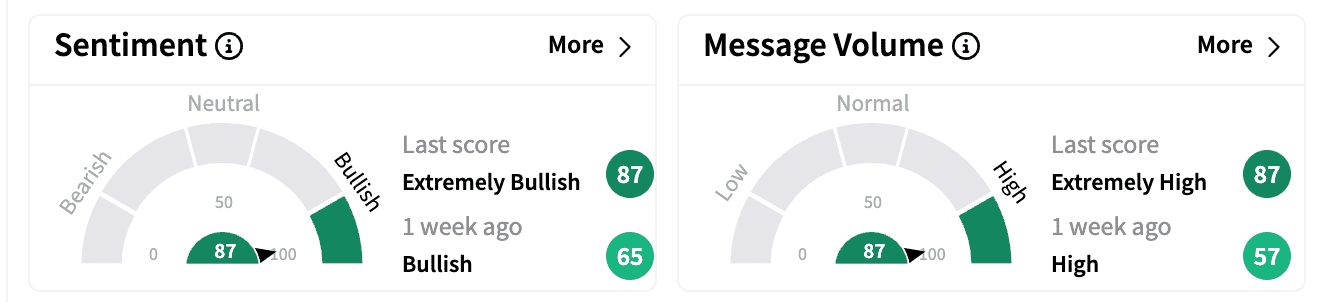

Sentiment on Stocktwits turned ‘extremely bullish’ from ‘bullish’ last week. Message volumes rose to ‘extremely high’ zone from ‘high.’

One Stocktwits user thought the stock’s pullback was an overreaction, while another reaffirmed faith in its brands’ strength.

Kraft Heinz stock is down 6.81% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1163170868_jpg_3975bd8be2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)