Advertisement|Remove ads.

Lucid Stock Outpaces Rivian, Tesla On Fresh 'Buy' Rating — But Retail's Not Convinced

Shares of Lucid Group Inc. climbed over 6% on Wednesday afternoon, set to break a four-session losing streak as the electric vehicle maker outpaced gains in bigger rivals Rivian and Tesla.

The rally followed a fresh bullish call from Benchmark analyst Mickey Legg, who initiated coverage with a 'Buy' rating and a $5 price target, implying nearly a 75% upside from current levels.

This is reportedly the only buy rating among the 13 analysts covering Lucid on Wall Street.

The analyst sees Lucid as well-positioned to capture a meaningful share of the EV market in the coming years, citing its technology, balance sheet, Saudi backing, "award-winning vehicles" and "highly integrated manufacturing capabilities."

Benchmark expects domestic EV production to rebound in 2025 and accelerate further through 2027 as prices decline and charging infrastructure expands.

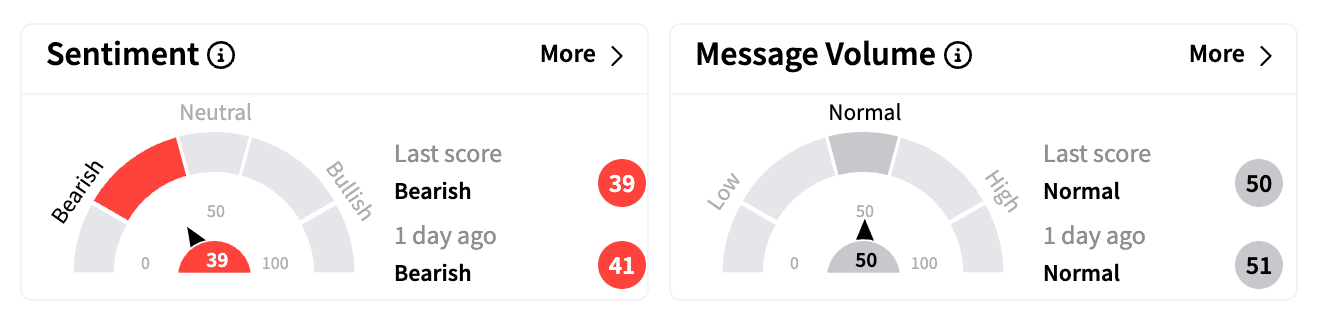

Despite the bullish call, sentiment on Stocktwits remained 'bearish.'

Many users expressed skepticism over Lucid's future, with one calling it a "long, slow death" and another pointing to the company's ongoing losses and lack of profitability.

Lucid, backed by Saudi Arabia's sovereign wealth fund, is set to report fourth-quarter results on Feb. 25. Wall Street expects an adjusted loss per share of $0.26 on revenue of $212.2 million.

The company continues to face challenges, including significant per-vehicle losses and recent cost-cutting measures such as workforce reductions.

Lucid reportedly lowered prices and introduced more affordable financing options last quarter to stimulate demand.

The EV maker currently sells the Air sedan and Gravity SUV and plans to launch a midsize platform by late 2026, targeting Tesla's Model 3 and Model Y.

However, the stock remains under pressure, down more than 18% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_ardelyx_jpg_488a3f8312.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252194207_jpg_9605cd50d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247687123_1_jpg_5a8fc404b7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243334218_jpg_b1b7c1b222.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Johnson_and_Johnson_jpg_bc42927ca0.webp)