Advertisement|Remove ads.

Mahindra Lifespace Shares: SEBI Analyst Sees Signs Of Trend Reversal On Robust Project Pipeline

Real estate firm, Mahindra Lifespace, saw nearly 2% gains on Monday following two significant developments, including a redevelopment project and land acquisition.

The company has been selected to redevelop a large residential project (four societies) in Malad, strengthening its presence in Mumbai’s high-demand western corridor. The project offers an estimated development potential of ₹800 crore. Redevelopment projects generally offer better margins and faster turnaround due to existing urban infrastructure, noted SEBI-registered analyst A&Y Market Research.

Additionally, the firm has also bought a 13.46-acre land parcel in Pune, estimated to give a development potential of ₹3,500 crore.

A&Y Market Research added that this move signalled a strong launch pipeline ahead. Pune remains one of India’s most resilient housing markets, especially for mid-premium housing.

Why This Matters For Investors?

A solid project pipeline translates into improved visibility for future cash flows. The analyst also highlighted that Mahindra Group’s brand backing adds to trust and execution strength.

However, one must keep a close eye on launch timelines, sales velocity, and margin profile from upcoming projects.

Technical Outlook

A&Y Market Research noted that Mahindra Life stock is currently trading within a range. Resistance is seen at ₹389, a level that was tested three times and indicated strong selling interest here. On the downside, support was identified at ₹339-₹345. The stock must hold these levels for a potential upside.

Given the repeated tests of the resistance level, they believe that a breakout above ₹389 with substantial volumes could signal a significant trend reversal.

What Is The Retail Mood?

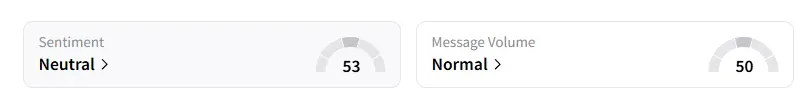

Data on Stocktwits showed that retail sentiment had turned from ‘bullish’ to ‘neutral’ a day ago.

Mahindra Life shares have declined 12% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)