Advertisement|Remove ads.

Mind Medicine Stock Rises As Evercore Projects 200% Upside On LSD Formulation: Retail Turns Bullish

Shares of Mind Medicine Inc. climbed over 2% on Tuesday afternoon, on track to break a two-session losing streak, as Evercore ISI initiated coverage with an ‘Outperform’ rating and a bullish $23 price target, suggesting over 200% upside from current levels.

Evercore analysts highlighted the company’s innovation in developing a novel oral formulation of LSD, with its lead asset MM120 targeting generalized anxiety disorder (GAD) and major depressive disorder (MDD).

The brokerage also pointed to potential large-scale expansion opportunities and emphasized the growing acceptance of psychedelics in future treatment paradigms.

Last month, Chardan initiated coverage with a ‘Buy’ rating and a $20 price target, citing MM120’s potential to deliver over $1 billion in peak sales by 2026, assuming positive trial data and a strong commercial launch.

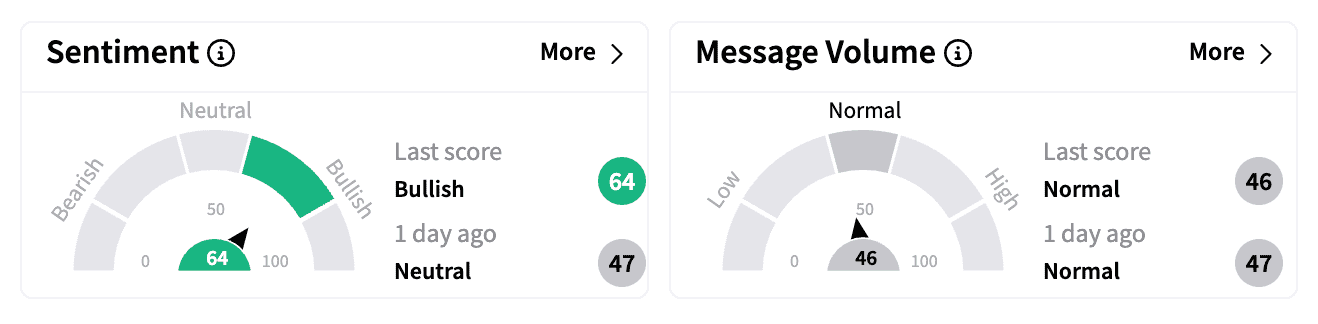

On Stocktwits, retail sentiment for Mind Medicine turned ‘bullish’ from ‘neutral,’ with increased message volume reflecting optimism.

Analysts expect sentiment to improve further in 2025, as the company nears key catalysts, including pivotal trial updates.

Mind Medicine recently launched a Phase 3 trial of MM120 in GAD and expanded its intellectual property protection through 2041 by obtaining a patent for an orally disintegrating tablet (ODT) formulation.

The Nasdaq Biotechnology Index (NBI) added the stock in December, which analysts noted could bolster institutional interest.

The company ended the third quarter of 2024 with $295.28 million in cash and $24.31 million in debt.

Mind Medicine recently said it raised $250 million last year through two equity financings.

The small-cap biotech’s stock has returned about 90% over the past 12 months, though its short interest stands at 13.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298117_jpg_2f7ddb9196.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Ram_83262cba1d.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_coinbase_new_jul_2eaf8eb2ac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)