Advertisement|Remove ads.

Wall Street's Hopes For Mobileye Fade As Trump Tariffs Rattle Auto Sector: Retail's Losing Faith Too

Shares of Mobileye ended in the red for a fourth straight session on Tuesday, with losses ballooning to over 15% in the past month and retail sentiment dipping as investors grow increasingly nervous about fluctuating U.S. trade policies.

On Tuesday, Baird analyst Luke Junk lowered the firm's price target on the autonomous driving technology firm to $17 from $25 but kept an 'Outperform' rating, as per The Fly.

The research firm reverted to a more cautious stance in the vehicle technology and mobility sector.

Baird thinks Mobileye's first-quarter results, due next week, should "be around" expectations, but the risk-to-reward "appears upside down."

The analyst expects guidance updates to be more challenging due to the likely disruption caused by President Donald Trump's initial auto tariffs.

Meanwhile, Barclays analyst Dan Levy downgraded Mobileye to 'Equal Weight' from 'Overweight' and cut his price target to $14 from $22 in a broader commentary on the effect of tariffs on auto and mobility earnings.

"Auto tariffs are seemingly here to stay, and valuations are seemingly not pricing in full tariff risk," the firm said, adding that the Mobileye downgrade reflects its thesis that auto tech is at risk of a slower uptake curve.

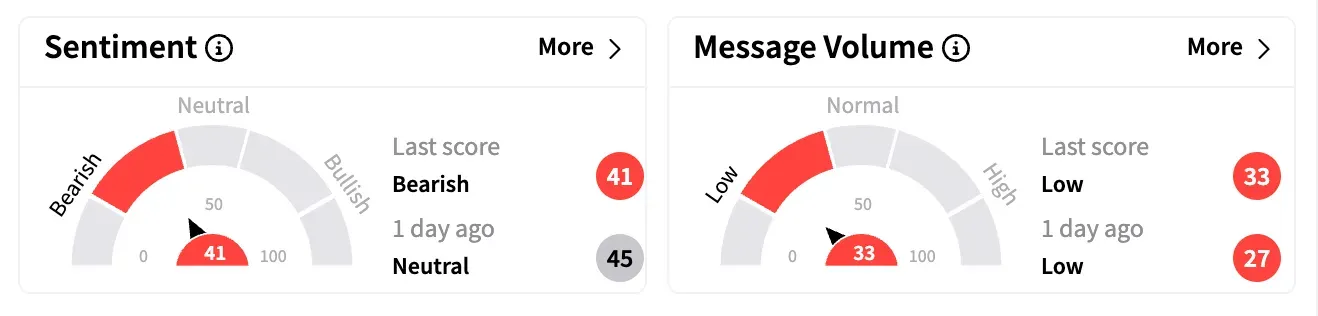

On Stocktwits, sentiment for Mobileye dipped into the 'bearish' zone from 'neutral' a day ago amid a slight uptick in message volume.

One user wondered if the stock would fall to single digits after the next earnings report.

Another said they were "picking some up for a couple [of] bucks risk/reward whatever one hits."

Wall Street expects Mobileye to report adjusted Q1 earnings per share of $0.08 on revenue of $434.63 million.

Last week, UBS and Goldman Sachs cut their price targets on Mobileye, citing potential pressure on auto demand from Trump's proposed auto tariffs.

The tariffs are currently paused as the administration explores carve-outs for companies facing the prospect of 25% duties on parts imported from Canada, Mexico, and other countries.

UBS said supply chains that were set up to be optimized over decades may "need to be reimagined" as the auto sector does not deal well with uncertainty given long planning cycles.

Mobileye stock has lost over 38% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)