Advertisement|Remove ads.

Newmont Stock Rises After-Hours As Q4 Earnings Smash Estimates, Management Stays Bullish On Gold Prices: Retail Sentiment Soars

Shares of Newmont Corp. (NEM) gained nearly 2% in after-hours trading on Thursday after the company’s fourth-quarter earnings blew past Wall Street estimates.

Newmont announced Q4 earnings per share (EPS) of $1.40, far ahead of the consensus estimate of $1.03, surging more than three times from $0.46 during the same period last year.

The company’s revenue in Q4 stood at $5.65 billion, compared to an estimated $5.32 billion.

Also aiding Newmont’s earnings during the quarter were its all-in sustaining costs for gold, which stood at $1,463 per ounce, falling 1.5% year-on-year.

For the fiscal year 2024, Newmont’s EPS stood at $3.48, compared to a consensus of $3.08. The company had posted an EPS of $1.57 in 2023.

Its revenue for 2024 was $18.68 billion, compared to $11.81 billion in 2023 – a growth of over 58%.

Newmont has beaten estimates in three of the past four quarters.

"2024 was a transformational year for Newmont, as we focused on the integration of the Newcrest portfolio, divestment of our non-core assets, and transitioning the business onto a stable operating and investment platform,” said CEO Tom Palmer.

Newmont produced 6.85 million ounces of gold in 2024. It generated $6.3 billion in operating cash flow and $2.9 billion in free cash flow.

For 2025, Newmont forecasts production of 5.6 million ounces of gold from its Tier 1 portfolio. Going forward, it has a production target of 6 million ounces of gold per year for the next decade.

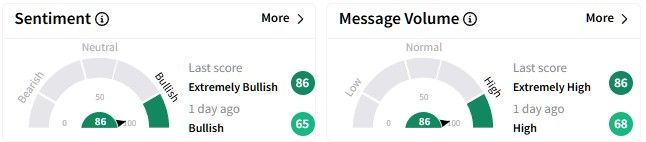

Retail sentiment on Stocktwits around the Newmont stock soared to enter the ‘extremely bullish’ (86/100) territory from ‘bullish’ a day ago.

One user thinks the Newmont stock could cross the $50 mark on Friday.

On the other hand, one year expressed caution saying that “gold is overbought,” and as such, a pull back could be on the horizon.

Despite gold prices shining, Newmont stock has lost some of its sheen recently – in the past six months, Newmont stock fell by over 7%.

In contrast, its one-year performance is stellar, with gains of nearly 45%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_LUNR_Intuitive_Machines_resized_jpg_5655032711.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_MSTR_caaa0be909.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)