Advertisement|Remove ads.

Netflix Stock Falls Ahead Of Q3 Earnings: Wall Street Divided, Retail Stays Confident

Shares of Netflix, Inc. ($NFLX) dipped over 1% on Thursday afternoon, just hours before the company is set to announce its third-quarter financial results and business outlook.

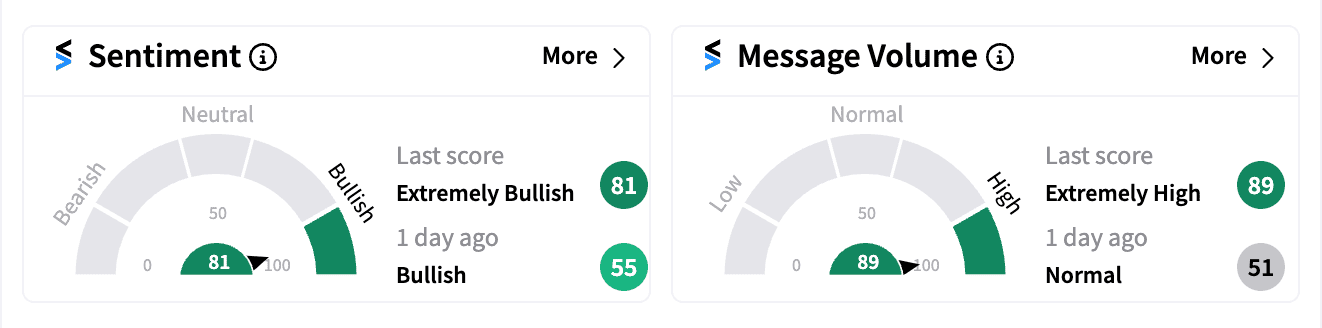

Despite the decline, retail investors on Stocktwits appeared confident, with the ticker trending among the top five symbols on the platform as of 11:30 a.m. ET.

Analysts expect Netflix’s adjusted earnings per share (EPS) to rise to $5.12, up from $3.73 a year earlier, with revenue projected to jump to $9.77 billion from $8.54 billion.

The FactSet consensus anticipates 3.5 million paid net additions for the quarter.

Retail sentiment among its nearly 483,000 followers was ‘extremely bullish’ by 11:15 am ET, despite selling pressure.

One user expects the stock “to soar after closing.”

Another predicted that the stock could go up as much as $780 on an earnings beat or drop to $620 if results fall short of Wall Street estimates.

Several analysts are predicting a potential price increase announcement from Netflix.

Citi anticipates Q3 net additions to exceed the 4.5 million sell-side estimate, focusing on the company’s advertising strategy, sports content, and capital allocation. Citi maintained a ‘Neutral’ rating with a $675 target price.

In the run up to earnings, Piper Sandler upgraded Netflix to ‘Overweight’ from ‘Neutral,’ raising the price target to $800 from $650, citing the company’s leadership in streaming and the potential for price adjustments in the ads-free business.

Conversely, Barclays downgraded Netflix to ‘Underweight’ with a target price of $550, warning that its premium valuation relies on sustained revenue growth, which they believe will be increasingly challenging.

Pivotal Research stands as Netflix’s biggest bull, with the highest price target of $900 and a ‘Buy’ rating, driven by robust subscriber growth forecasts.

Benchmark, the biggest bear, argues that Netflix’s growth will hinge on pricing and new initiatives, “given mounting consumer wallet resistance to price hikes as well as member growth concentration in much lower price point emerging markets”. It has a ‘Sell’ rating with a target price of $545.

Netflix shares have gained 48.5% so far this year, buoyed by cost-cutting measures, ad introductions, and a crackdown on password sharing, while still attracting new subscribers.

Read next: Robinhood Gets Price Target Hike From JPMorgan After New Product Rollout: Is Retail More Bullish?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Musk_Space_X_jpg_28cee07c59.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236938640_jpg_8fcb9d37f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_davita_jpg_13b44ed3a6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paypal_OG_jpg_20b795c771.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247643016_jpg_cb99ad1ed2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)