Advertisement|Remove ads.

Nifty Below 24,800: SEBI RAs Warn Index May Test Lower Support Levels

Indian markets fell for the third consecutive session on Thursday, with the Nifty ending below 24,800.

SEBI-registered analyst Bharat Sharma of Stockace Financial Services observed that the index saw a relatively subdued expiry session, with a sharp fall in the final 15 minutes of trading, indicating a bearish signal. However, the difference between the session’s low and closing level was only about 50 points.

He added that the Nifty closed below its 20-day Exponential Moving Average (EMA), slightly breaching the support level at 24,800. Looking ahead, Sharma expects the Nifty to test the lower boundary of its downward channel before seeing any reversal, implying a gap-down opening is probable on Friday.

Immediate support is identified at 24,730, which, if breached, can lead to lower supports of 24,650-24,580-24,500, respectively.

On the upside, Sharma pegged immediate resistance at 24,840-24,850. He noted that the 200-day EMA posed some resistance, and hence a break above that would push the Nifty to 24,880-24,900, with a potential move beyond 25,000 if the momentum sustains.

Meanwhile, analyst Praveen Girotra observed that he is not seeing convincing strength across the board. He believes that a healthy correction might do more good than harm at this point.

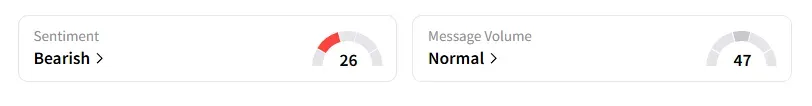

Data on Stocktwits shows that retail sentiment on the Nifty has moved from ‘extremely bearish’ to ‘bearish’ on Friday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247874160_jpg_4fb51355e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)