Advertisement|Remove ads.

Nifty Holds 24,700 Led By Buying In Autos, Metals; Retail Sentiment Turns ‘Neutral’

Indian equity markets remained rangebound, ending off the day’s high but in the green territory, with the Nifty index holding above 24,700 levels.

On Monday, the Sensex closed 86 points higher at 80,787, while the Nifty 50 ended up 33 points at 24,773. Broader markets fared better, with the Nifty Midcap gaining 0.5% and the Nifty Smallcap index rising 0.1%.

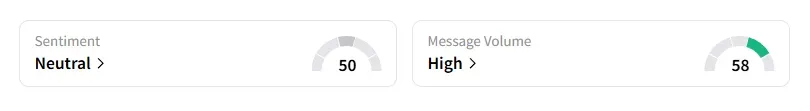

The retail investor sentiment surrounding the Nifty 50 shifted from ‘bearish’ to ‘neutral’ by market close on Stocktwits.

Stock Moves

Sectorally, technology was the biggest loser, followed by pharma, consumer durables, and FMCG. On the other hand, autos were the top-performing sectors (+3.3%), followed by metals and real estate. M&M, Eicher Motors, Maruti, TVS Motor hit fresh 52-week highs.

JSW Steel, Tata Steel, and SAIL ended over 2% higher following an upgrade from Morgan Stanley. Meanwhile, Vedanta ended 2% lower on concerns over it emerging as the largest bidder for JP Associates.

Prime Focus hits 10% upper circuit for the second day following large block deals.

IDBI Bank ended 4% higher after reports emerged that four bidders have been shortlisted to pick up a stake in the bank.

Stock Calls

Analyst Financial Sarthis flagged a breakout in IOL Chemicals following the formation of a multi-week rectangle pattern on its charts. Support has been identified at ₹85-₹86, with resistance at ₹103-₹104, supported by huge volumes. They expect a potential 30% to 40% upside in this stock.

Kapil Aggarwal of Investkaps recommended buying Lumax Tech at current market price for a target price of ₹1,400, and a stop loss of ₹1,114 by November 25.

And Palak Jain recommended buying Quality Power above ₹929, with a stop loss at ₹817, for target prices of ₹957, ₹985, and ₹1,040. A rounding bottom pattern, accompanied by strong volume buildup, signals bullish momentum and trend continuation.

Markets: What Next?

Globally, European markets traded higher, while US stock futures indicate a cautious start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2204154647_jpg_b295df5f6b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Norwegian_Cruise_jpg_ba826c7555.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)