Advertisement|Remove ads.

Indian Markets End Lower For Fifth Day, Nifty Closes Below 24,900

Indian equity markets saw heavy selling in the last hour of trade, dragging the Nifty index below 24,900. Benchmarks have closed lower for the fifth consecutive session, led by selling in technology, real estate, auto, and pharmaceutical sectors.

On Thursday, the Sensex closed 555 points lower at 81,159, while the Nifty 50 ended down 166 points at 24,890. Broader markets also saw selling pressure, with the Nifty Midcap and Smallcap indices closing more than 0.5% lower.

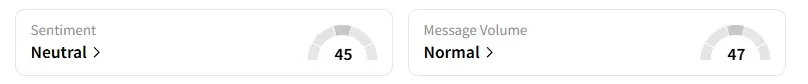

The retail investor sentiment surrounding the Nifty 50 moved from ‘bearish’ to ‘neutral’ by market close on Stocktwits.

Stock Moves

Tata Motors ended nearly 3% lower after Jaguar Land Rover stares at a potential £2 billion loss from the cyberattack hit and production being halted until October.

Hindustan Copper surged 6% following record-high copper prices.

Hindustan Aeronautics (HAL) shares rose over 1% after the defense company signed a ₹62,370 crore contract to supply 97 LCA Mk1A jets to the Air Force.

Stock Calls

SEBI analyst Kush Ghodasara flagged a bearish call on Interglobe Aviation (Indigo). He noted that the stock has moved from ₹3,900 to ₹6,250 in 9 months and has exhibited some negative divergence with the RSI and MACD, which suggests that it may move below ₹5,500.

Ghodasara added that a close below ₹5,800 this week will confirm its breakout from the upward-sloping channel, which suggests a good breakdown. Additionally, the stock closing below ₹5,750 would confirm a crossover from a five-week average to a 15-week average on the negative side, suggesting a sell recommendation for the stock.

He recommended selling Indigo futures near the current market price (₹ 5,677) with a stop-loss at ₹ 5,750 for a target price of ₹ 5,559 and ₹ 5,420.

Markets: What Next?

Globally, European markets traded lower, while US stock futures indicate a cautious start on Wall Street.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_btc_x_96cc54b79b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)