Advertisement|Remove ads.

Nifty Holds 25,000 As Midcaps Outperform; Lupin, Prestige, Saatvik, HFCL Among Top Movers

Indian equity markets opened firm, with the Nifty index holding on to the crucial 25,000 support level. Metals, pharma, and energy lead the gains, while autos and select financials saw some selling pressure in early trade.

At 10:00 a.m. IST, the Nifty 50 traded 6 points higher at 25,051, while the Sensex was flat at 81,773. Broader markets outperformed, with the Nifty Midcap index rising 0.35, and the Smallcap index gaining 0.1%.

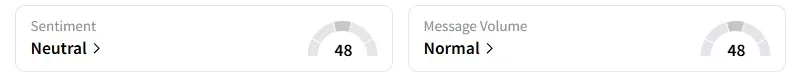

The retail sentiment on Stocktwits for the Nifty has moved to ‘neutral’ at market open.

Stock Watch

TCS shares traded subdued ahead of the Q2 earnings print later this evening.

Saatvik Green shares hit 10% upper circuit after stellar Q1 earnings performance. Profit surged 459.3% to ₹118.8 crore, while revenue soared 272.3% to ₹915.7 crore.

Lupin's shares rose 3% on the company’s plans for a new pharmaceutical manufacturing plant in Coral Springs, Florida, with a cumulative investment of $250 million in the next five years.

Prestige Estates surged 5% after the real estate company recorded robust sales during the September quarter, registering a 50% year-on-year growth.

Eternal (Zomato) shares rose over 1% after brokerage firm Citi raised its target price, anticipating strong growth trajectory.

HFCL gained 2% on securing export orders worth $34.19 million from a renowned international customer for the supply of optical fiber cables, through its overseas wholly owned subsidiary. The order is to be executed by April 2026.

And GR Infraprojects rose over 3% on securing an agreement from the Jharkhand Highway Authority for a ₹290.23 crore EPC road construction project, the Giridih Bypass.

Garuda surged 9% on receiving a ₹143.96 crore worth of civil work orders from Orbit Ventures Developers for the Shikhar-B redevelopment project in Oshiwara, Mumbai.

Hindustan Copper surges 4% as global copper prices hit a record high.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Thursday with a 1-week timeframe:

Paradeep Phosphates: Buy at ₹189.70, for a target price of ₹199, and a stop loss at ₹184

SBI Card: Buy at ₹920, with a target price of ₹938, and a stop loss at ₹910

HAL: Buy at ₹4,789, with a target price of ₹4,880, and a stop loss at ₹4,738

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Analyst Prabhat Mittal identified Nifty support at 24,880 with resistance at 25,220. For Bank Nifty, he sees support at 55,600 and resistance at 56,300.

Ashish Kyal noted that Nifty’s close below the previous day’s low indicates potential weakness. A break below 24,980 could take the index to 24,920 levels in the short term. However, market timing models suggest that momentum may turn upward around 11:15 am. If positive price action emerges at this time, it could show a retest of the 25,120 level.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices declined as traders monitored the Gaza peace efforts and US inventories.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)