Advertisement|Remove ads.

Indian Markets Firm Ahead Of Expiry: Nifty Tops 25,100 Led By Metals, Energy

Indian equity markets opened the weekly expiry session on a strong note, with the Nifty index scaling 25,100 in early trade.

At 09:50 a.m. IST, the Nifty 50 traded 93 points higher at 25,171, while the Sensex was up 350 points at 82,140. Broader markets mirrored the strength, with the Nifty Midcap index rising 0.3% and Smallcap index gaining 0.5%.

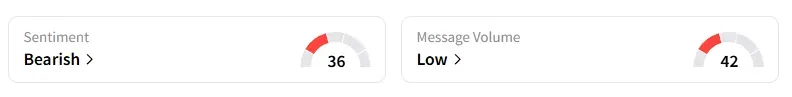

The retail sentiment on Stocktwits for the Nifty remained ‘bearish’ at market open amid ‘low’ message volumes.

Stock Watch

Sectorally, barring mild weakness in certain PSU bank and healthcare counters, rest of the indices traded in the green, led by metals, energy, and real estate.

Trent was the top Nifty loser, falling over 2% on the back of weaker sales growth in its operational business update for September quarter.

Dilip Buildcon shares rose 2% after the company, through a joint venture, secured an agreement for developing a 100 MW solar power project to supply electricity to Madhya Pradesh Jal Nigam for 25 years.

Brigade Enterprises also rose 2% on signing a pact for a premium residential project on a 6.6-acre land parcel in West Chennai, with an estimated GDV of ₹1,000 crore.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Tuesday with a 1-week timeframe:

TCS: Buy at ₹2,989, with a target price of ₹3,047, and a stop loss at ₹2,958

Paytm: Buy at ₹1,224.20, with a target price of ₹1,247, and a stop loss at ₹1,210

Nykaa: Buy at ₹255.34, with a target price of ₹270, and a stop loss at ₹250

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Analyst Prabhat Mittal identified Nifty support at 24,880 with resistance at 25,220. For Bank Nifty, he sees support at 55,700 and resistance at 56,500.

Ashish Kyal said the Nifty has continued to move as per time & Neowave. For Tuesday, if prices move to 25,020 and form a reversal on the 15-minute timeframe AK indicator, it would generate a buy signal with a stop loss at 24,920. Short-term target seen at 25,150-25,180, with a positional move extending to Gann levels of 25,361, unless it closes below its prior low.

Varunkumar Patel noted that foreign investors sold over ₹300 crore in cash while building fresh index short positions in F&O and cutting down net index calls. Their overall index future shorts remain at record-high levels, indicating a continued cautious stance on the market.

He expects Nifty to stay within the 24,300–25,000 range until the result season. However, with the index closing above 25,000, the probability of a short-term consolidation or mild correction has increased as the market digests recent gains.

Global Cues

Globally, Asian markets traded higher, led by strong momentum in Japanese markets, which are rallying on optimism around the incoming Prime Minister. Bullion continues its strong upward trend, supported by macro uncertainties and safe-haven buying.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)