Advertisement|Remove ads.

Nifty Scales 25,000 As India-US Trade Talk Optimism Lifts Markets; Textile, Seafood Export Stocks Shine

Indian equity markets opened on a strong note as hopes of progress in trade resolution between the US and India revived investor sentiment. The Nifty index rises past 25,000 intraday for the first time since August 25.

In a post on Truth Social on Tuesday, Trump wrote that he anticipates a successful conclusion to trade talks with PM Modi soon. Prime Minister Narendra Modi responded on X, confident that trade negotiations would unlock the limitless potential of the India-US partnership, calling the nations "close friends and natural partners."

At 10:00 a.m. IST, the Nifty 50 traded 136 points higher at 25,005, while the Sensex was up 412 points at 81,513. Broader markets surged too, with the Nifty Midcap index rising 0.7% and the Smallcap index trading 0.9% higher.

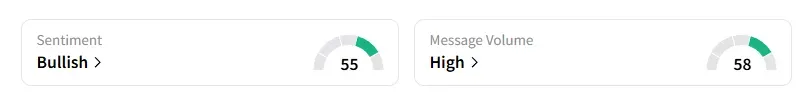

The retail sentiment on Stocktwits for Nifty has shifted to ‘bullish’ at market open.

Stock Watch

Sectorally, barring mild weakness in autos, all sectors traded in the green. The IT index surged 2% for the second straight session, followed by strong buying in PSU banks.

Textile stocks saw buying interest on US-India trade deal optimism. Alok Industries, Vardhman Textiles rose 5%, and Welspun Living surged 8%.

Seafood export stocks such as Avanti Feeds and Apex Foods surged 10% after the European Union approved 102 new Indian fishery establishments for exports to the European Union on Tuesday.

Vodafone Idea gained over 1% after it filed a fresh plea in the Supreme Court in the Adjusted Gross Revenue (AGR) case.

Blue Jet Healthcare shares fell 2% as its promoter, Akshay Bansarilal Arora, looks to sell up to 6.83% stake through an OFS on September 10 - 11, with a floor price of ₹675 per share.

Sterling and Wilson surged 4% on securing a ₹415 crore contract for a 300 MW AC solar project in Rajasthan.

And Vikram Solar rallied over 12% after the company reported a 483.9% jump in consolidated Q1 profit to ₹133.4 crore, while revenue surged 79.7% to ₹1,133.6 crore.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Wednesday with a 1-week timeframe:

Astral: Buy at ₹1,460, for a target price of ₹1,500, and stop loss at ₹1,440

Arvind: Buy at ₹298, for a target price of ₹320, and stop loss at ₹290

Biocon: Buy at ₹364, for a target price of ₹385, and stop loss at ₹355

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Pradeep Carpenter expects a positive start on the back of global cues and trade deal optimism. He identified support at 24,800 and 24,700 for the Nifty, with resistance at 25,000 and 25,100. Carpenter advised watching for a breakout above 25,154 (the August 21 high) and noted that Bank Nifty’s approach to its 20-day moving average will be crucial.

Ashish Kyal said that a close above 24,890 on the 15-minute timeframe will push the index to 24,970, with support near 24,790. A break below it can retest the Gann 24,728 levels.

Sameer Pande sees resistance between 25,000 and 25,100, adding that a breakout may trigger a rally. Support is seen around 24,750 and 24,500.

Global Cues

Globally, Asian markets traded mostly higher, while crude oil prices rose as investors analyzed the latest US tariff threats on Russian crude buyers.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1463539842_jpg_bcfa58ea0b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)