Advertisement|Remove ads.

Indian Markets Open Higher, Nifty Above 24,700; BEL, Tata Motors Lead Gains, HUL Slides

Indian equity markets opened on a positive note with the Nifty index gaining above 24,700. Investors will be watching commentary on the India-US trade deal as well as the rate decision from India’s central bank this week.

At 09:40 a.m. IST, the Nifty 50 traded 79 points higher at 24,734, while the Sensex was up 239 points at 80,666. Broader markets gained, with the Nifty Midcap and Smallcap indices rising 0.5%.

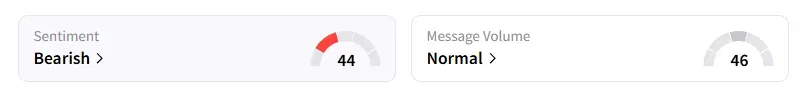

The retail sentiment on Stocktwits for the Nifty moved to ‘bearish’ from ‘neutral’ at market open.

Stock Watch

Sectorally, barring FMCG, all sectors traded in the green, led by real estate, metals and technology.

HUL shares fell over 2% after the company guided for flat to low-single digit Q2 growth and expects demand recovery from November. It’s the top Nifty loser.

On the other hand, Bharat Electronics (BEL) was the top Nifty gainer, rising over 2%. The Indian Army has issued a tender to acquire five to six regiments of 'Anant Shastra' surface-to-air missile weapon systems.

Tata Motors gained 1% after the UK government cleared a £1.5 bn loan guarantee for its British unit, Jaguar Land Rover (JLR), following the cyberattack hit.

L&T fell over 1% after BofA downgraded the stock to Underperform from Buy with a target price of ₹3,700.

Vascon Engineering surged 13% following an MoU for a five-year partnership with Adani Infra. Azad Engineering gained over 2% on securing a ₹651 crore contract from Mitsubishi Heavy.

And Samman Capital surged over 6% after the stock was removed from the F&O ban list.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Monday with a 1-week timeframe:

Max Healthcare: Buy at ₹1,123, for a target price of ₹1,150, and stop loss at ₹1,110

IRFC: Buy at ₹121.90, for a target price of ₹125, and a stop loss at ₹120

Godrej Agrovet: Buy at ₹715, for a target price of ₹730, and a stop loss at ₹708

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Analyst Ashish Kyal highlighted that the Nifty index is oversold over the short term, and hence a ‘sell on rise’ strategy would be better. If it moves towards 24,740 and forms a reversal on the 5-minute Ichimoku, then sell for a move to 24,640-24m600 levels. The Nifty needs a hourly close above 24,830 for a positive outlook.

Prabhat Mittal identified Nifty support at 24,500 with resistance at 24,800. For Bank Nifty, he sees support at 53,900 and resistance at 54,700.

Sunil Kotak noted that the trendline indicated significant support at 24,500 and expects it to hold. But he remains bearish till the index crosses 24,850-24,900.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices extended their decline following reports that OPEC is considering another output hike.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239275331_jpg_81be89c46a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2166957713_jpg_a9ada70a7b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)