Advertisement|Remove ads.

Indian Markets Rally As Iran Looks To Defuse Tensions With Israel: SEBI RA Eyes Breakout Above 25,200 For Nifty

Indian markets opened on a strong note on Tuesday, extending the global cheer after U.S. President Donald Trump announced a ceasefire between Iran and Israel. Neither Iran nor Israel has publicly accepted the ceasefire, but Iran has indicated a willingness to cease striking Israel if Israel reciprocates.

The Nifty hit its highest level this year, briefly testing 25,200. At 9:45 a.m. IST, the Nifty 50 traded 187 points higher at 25,159, while the Sensex rose 598 points at 82,495.

Meanwhile, the India Volatility Index (VIX), a key gauge of market fear, fell 2%.

Broader markets mirrored the broad-based optimism, with the Nifty Midcap and Smallcap indices rising 0.6%.

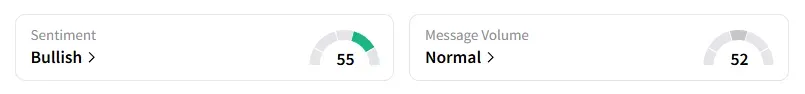

On Tuesday, the retail sentiment on Stocktwits for Nifty has flipped from ‘bearish’ to ‘bullish’.

Sectorally, barring media stocks, all the indices traded in the green, led by heavy buying in PSU banks, real estate and auto stocks.

Crude oil prices fell below $70/barrel, sparking a rally in oil-sensitive sectors. IOC, HPCL, BPCL shares gained between 2% to 4%, while Oil India and ONGC shares slipped over 2%. Adani Ports is the top Nifty gainer, up 4% as the geopolitical tensions in the Middle East eased.

On the flip side, defense stocks witnessed profit booking. Bharat Dynamics, BEML, GRSE, and Paras Defence fell over 3%.

KPIT Technologies’ shares fell over 4% after management warned in its mid-quarter update that the overall business environment remains uncertain. Brokerage firm Kotak Institutional Equities maintains a ‘Sell’ rating with a target price of ₹1,000, indicating a 28% downside.

Vodafone Idea shares gained over 2% on news reports that the Indian government is mulling options to provide relief on its ₹84,000 crore dues.

Page Industries surged over 2% as Goldman Sachs initiates coverage with a ‘Buy’ rating and target price of ₹52,000, indicating 15% upside.

NTPC fell over 2% on the back of a large block deal in early trade.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal observed that Nifty is trading in a tight range, with a 15-minute close above 25,060 likely to push the index to 25,150 levels or higher. On the downside, Kyal noted 24,820 as the immediate support. He expects markets to trade between 25,150 and 24,820, adding that despite the geopolitical developments, the daily bias remains positive as indicated by the three-candlestick rule.

A&Y Market Research sees Nifty intraday resistance between 25,187-25,238 and support between 24,746-24,811. For Bank Nifty, they peg resistance at 56,467-56,510 and support at 55,930-56,050.

Financial Independence suggests watching for an index move above 25,200 for a clear breakout.

Globally, Asian markets traded higher, while crude oil prices slipped to their lowest levels in more than a week in Asia.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)