Advertisement|Remove ads.

Nifty Holds Above 25,500 Amid Cautious Start, Broader Markets Outperform; PSU Banks, Pharma Stocks Rally

Indian markets opened on a cautious note on Monday, with the Nifty holding above the 25,500 level.

At 10:00 a.m. IST, the Nifty 50 traded 69 points lower at 25,568, while the Sensex was 264 points lower at 83,794.

Broader markets outperformed, with the Nifty Midcap gaining 0.3% and the Smallcap index rising over 0.8%

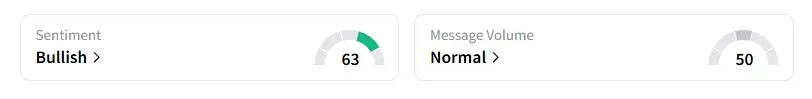

The retail sentiment on Stocktwits for Nifty remained ‘bullish’.

Sectorally, it’s a mixed picture, with PSU banks and pharmaceutical stocks seeing buying. On the flip side, IT, metals, private banks, and real estate shares are under pressure.

JB Pharma shares fell over 6% after Torrent Pharma acquired a controlling stake in the company for ₹11,917 crore, followed by a mandatory open offer to purchase up to an additional 26%. The deal valued JB Pharma at an equity valuation of ₹25,689 crore. Torrent Pharma shares gained 0.5%.

Waaree Energies gained over 2% after its subsidiary received an order to supply 540 MW of solar modules to a US-based developer.

ITD Cementation shares rose 5% after securing an international marine contract worth nearly ₹580 crore, and Hind Rectifiers shares rose 6% following an order win from the Indian Railways.

Schloss Bangalore, Aegis Vopak Terminals shares traded 2% lower as their IPO lock-in period ended.

Shares of Jyoti CNC Automation fell nearly 4% after 6% stake reportedly changed hands in a large block deal.

And RBL Bank rose 3% as Citi maintains a ‘Buy’ rating with a target price of ₹285, indicating a 20% upside.

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Prabhat Mittal pegged immediate support for the Nifty at 25,480 and resistance at 25,900, while he placed Bank Nifty support at 57,100 and resistance at 57,900.

Sameer Pande pegged Nifty support between 25,500 and 25,200, with resistance at 25,800.

Globally, Asian markets traded higher on Monday, while crude oil prices declined, following the worst weekly decline in over two years. This came after reports suggested that OPEC+ was considering another production hike amid easing tensions in the Middle East.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)