Advertisement|Remove ads.

Nifty Opens Below 25,100; IT, Pharma Weigh While Rail, Defense Stocks Shine

Indian equity markets opened on a subdued note, with the Nifty index slipping below the 25,100 mark, led by weakness in the technology and pharmaceutical sectors.

At 09:45 a.m. IST, the Nifty 50 traded 25 points lower at 25,088, while the Sensex was down 41 points at 81,863. Broader markets outperformed, with the Nifty Midcap index rising 0.3% and the Smallcap index trading 0.6% higher.

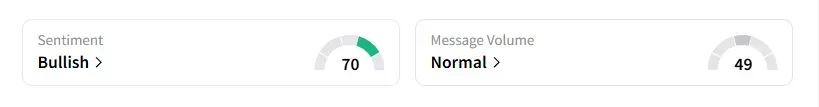

The retail sentiment on Stocktwits for Nifty has remained ‘bullish’ at market open.

Stock Watch

Sectorally, the IT sector saw some profit booking after the run-up last week, followed by a dip in pharma and healthcare. On the other hand, real estate and PSU banks saw some buying action.

The defense sector continued to see buying action, with Cochin Shipyard, Paras Defence, and Astra Micro surging over 3%.

Railway stocks are also seeing positive momentum. Railtel surged 7% following another order win. Other movers include IRCON (+7%), Titagarh, RVNL (+4%), and Texmaco (+3%).

In other news, Tata Technologies’ shares rose by over 1% after the company acquired the Germany-based ES-Tec Group for €75 million, with completion expected by December 2026.

Vedanta rose over 1% after Talwandi Sabo Power signed a settlement agreement with SEPCO Electric Power Construction to resolve all long-standing disputes related to the EPC contracts for its 3x660 MW Thermal Power Project.

Shakti Pumps surged 5% on securing a second order worth ₹374.41 crore from MSEDC for 12,451 off-grid solar water pumps, taking its total confirmed orders under the scheme to ₹616.30 crore.

And KRBL tanked nearly 10% after an independent director resigned citing governance issues.

Stock Calls

Analyst Vinayak Gautam shared three stock recommendations for Monday with a 1-week timeframe:

Larsen & Toubro: Buy at ₹3,579 with a target price at ₹3,650, and stop loss of ₹3,550

Adani Power: Buy at ₹648 with a target price at ₹670, and stop loss of ₹640

Alembic Pharma: Buy at ₹946 with a target price at ₹965, and stop loss of ₹935

Arun Mantri suggested keeping Tata-owned Nelco on buyers’ radar, as the stock looks good at the current price. The bullish outlook is driven by the company’s presence in the defense sector now and a solid technical chart after a steep correction.

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

A&Y Market Research pegged the intraday Nifty resistance at 25,215 - 25,246, with support at 25,009 - 25,075. For Bank Nifty (Intraday), resistance is seen at 55,055 - 55,168, with support at 54,492 - 54,587.

Pradeep Carpenter noted that markets remain in a bullish structure with Nifty above 25,000, Sensex holding 81,600, and Bank Nifty eyeing 55,000. Option data suggests a controlled upward bias with strong put-writing support at 25,000. And that stock action is tilted towards defense, metals, and select financials, while consumer & discretionary names show weakness. For the Nifty index, he identified support between 25,000-24,900, with resistance at 25,250–25,350.

SEBI-registered investment advisor Nidhi Saxena of Trade Bond flagged that Foreign Portfolio Investors (FPIs) have pulled out nearly $11.7 billion from Indian equities and debt in 2025, triggering pressure on key sectors and the rupee. Additionally, the tariff concerns have clouded earnings visibility for export-dependent businesses. She added that the impact is visible in financials, banks, and large-cap heavyweights, which are seeing persistent selling pressure. However, a weaker rupee could support IT and pharma earnings in the near term, creating a sectoral divergence.

According to Saxena, markets are showing signs of range-bound movement near 25,000 as domestic inflows try to balance FPI exits. She advised traders to watch for increased intraday volatility, lower liquidity in certain stocks, and sharp sector rotations.

Global Cues

Globally, Asian markets traded mixed, while crude oil prices gained as traders weighed moves to crack down on Russian flows.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)