Advertisement|Remove ads.

Nio Vs. Xpeng: Retail Traders Believe This Chinese EV Maker Is A Better Long-Term Bet

Chinese EV startups Nio and Xpeng are closely watched by retail traders, with their U.S.-listed shares amassing over 441,000 followers on Stocktwits.

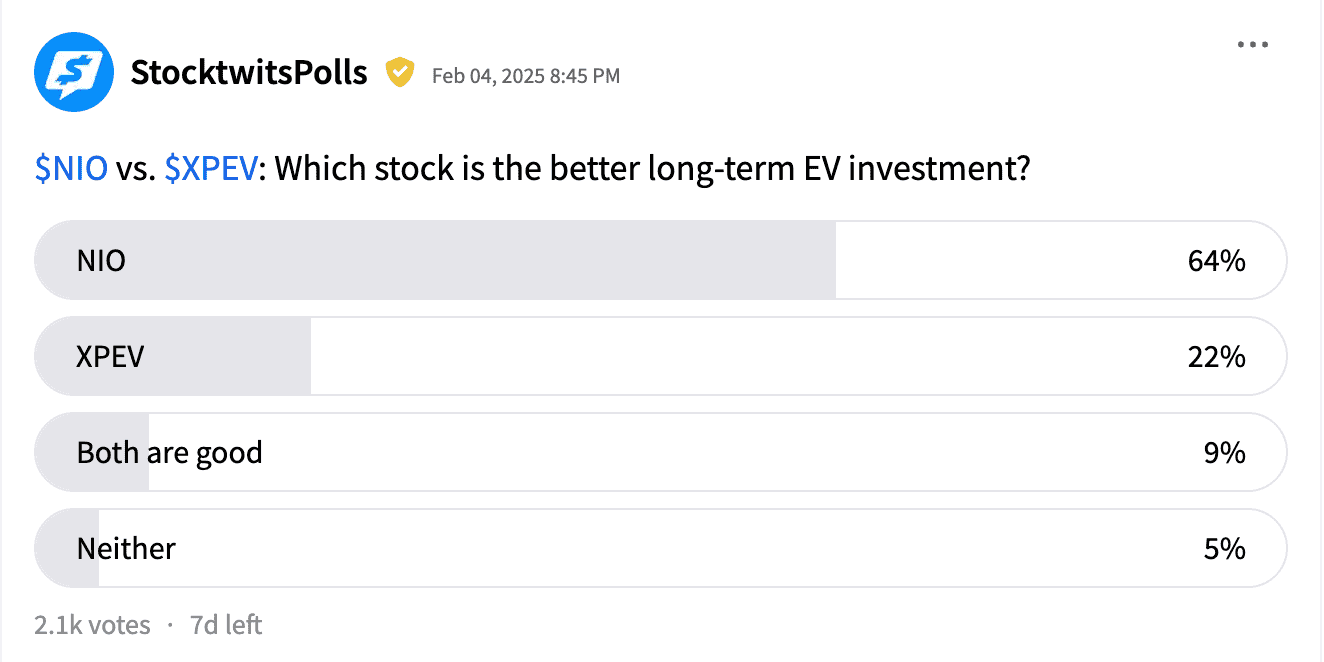

While both companies have seen strong delivery growth, a recent Stocktwits poll shows 64% of retail traders favor Nio over Xpeng, which garnered just 22% of the vote.

Nio delivered 221,970 vehicles in 2024, a 38.7% increase year-over-year, while Xpeng's annual deliveries rose 34% to 190,068 units.

However, early 2025 trends favor Xpeng, which delivered 30,350 vehicles in January, surging 268% year-over-year. In contrast, Nio delivered 13,863 cars, up 37.9% from a year ago.

Nio CEO William Li in December acknowledged that the company's 30-40% growth rate over the past three years was unsatisfactory, raising concerns among investors.

He had also denied that the Onvo brand was cannibalizing Nio's core business, attributing a recent sales slowdown to a reduction in promotional activities.

Despite its popularity among retail traders, Nio has struggled on Wall Street. On Tuesday, JPMorgan downgraded the stock to 'Neutral' from 'Overweight,' slashing its price target to $4.70 from $7, which still presents an upside of about $0.50 from Thursday's close.

The brokerage cited Nio's high-end ET9 sedan as a potential margin booster but warned its limited market appeal could cap growth.

Meanwhile, Xpeng's stock has soared over 47% year-to-date, compared to Nio's nearly 5% decline.

According to Koyfin data, Xpeng trades at about 1.7 times the estimated 2025 sales, while Nio trades at a cheaper rate of 0.8 times.

However, Xpeng's stock price is about 13% above analysts' average target of $14.80, whereas Nio trades at a steep 46% discount.

Some analysts may turn more bullish on Chinese EV stocks if Beijing delivers on promised policy support.

Late last year, China's Politburo announced plans for "more proactive fiscal policies and moderately loose monetary policies," which briefly boosted shares of domestic EV makers.

Ultimately, while retail sentiment leans toward Nio, Xpeng's stronger delivery momentum and stock performance can potentially turn the tables on investor preference — if it continues at this breakneck pace.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)