Advertisement. Remove ads.

Pre-Market Trends: Retail Traders Glued To Nvidia, Intel, Apple Amid Market Mayhem

U.S. stock market indexes are bracing for a rough opening Monday, with futures plummeting as the yen “carry trade” unwind and recession fears grip investors. However, amidst the sea of red, retail investors are displaying a mix of optimism and caution towards several tech giants. These were the most-watched stocks pre-market Monday, and how retail investors on Stocktwits felt about them as of 8:00 am ET.

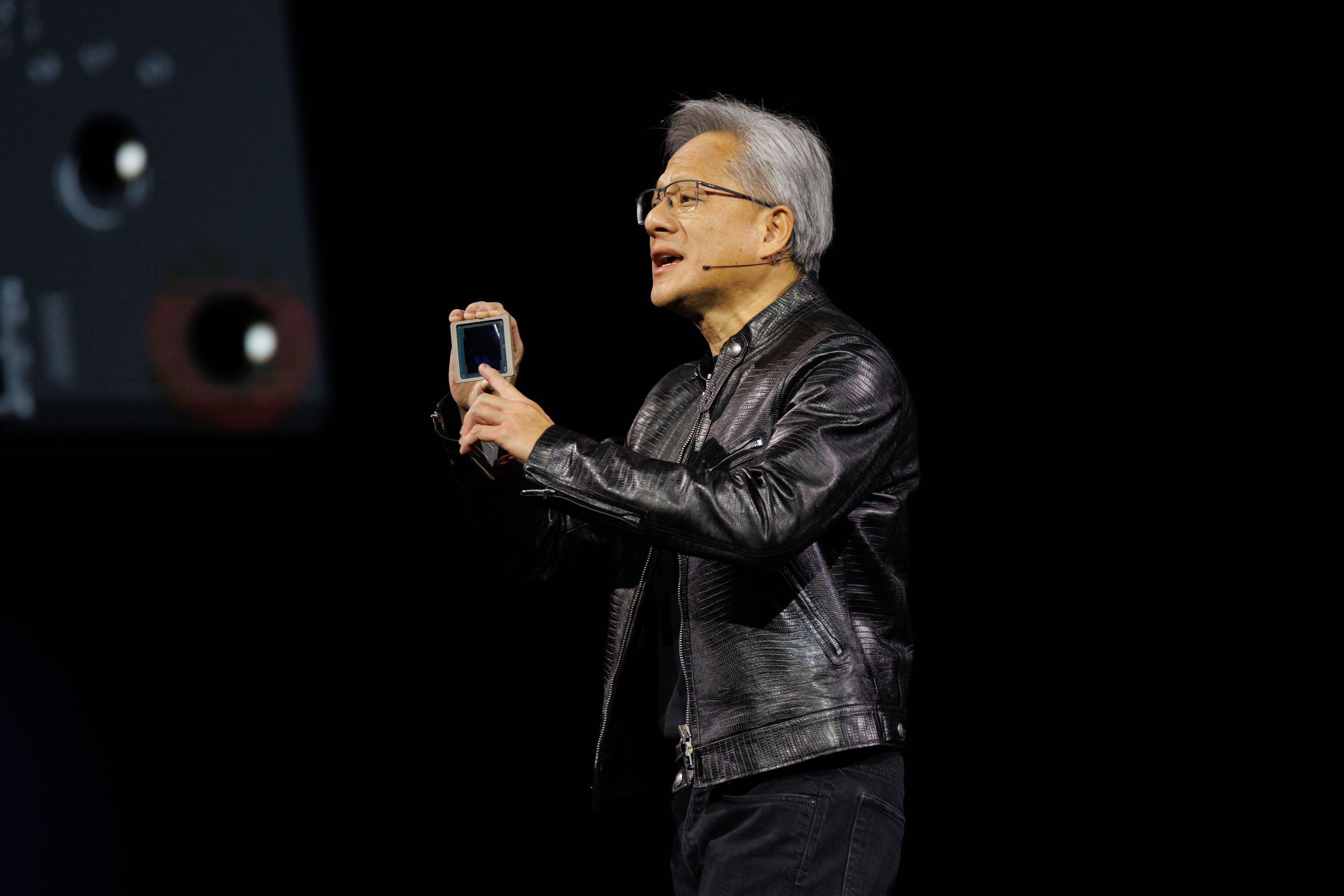

Nvidia Corp. (NVDA): Bucking the broader market trend, retail sentiment for Nvidia is ‘bullish’ (77/100) on Stocktwits. Despite a near 10% pre-market drop, retail investors are viewing it as a buying opportunity. High message volume suggests active discussions, with some posts encouraging holding through the market volatility.

“It’s going to get a little bit bumpy the coming weeks, but the markets will recover as usual,” read a popular bullish post from a user named ‘Sumsar’.

News from Hong Kong's The Standard, claiming Nvidia is on track with its AI chip production despite rumors of delays, added fuel to the optimism. However, the upcoming Q2 earnings report, expected later this month, will be a key test for the company. Even with the recent slide, Nvidia’s stock is up 122% year-to-date.

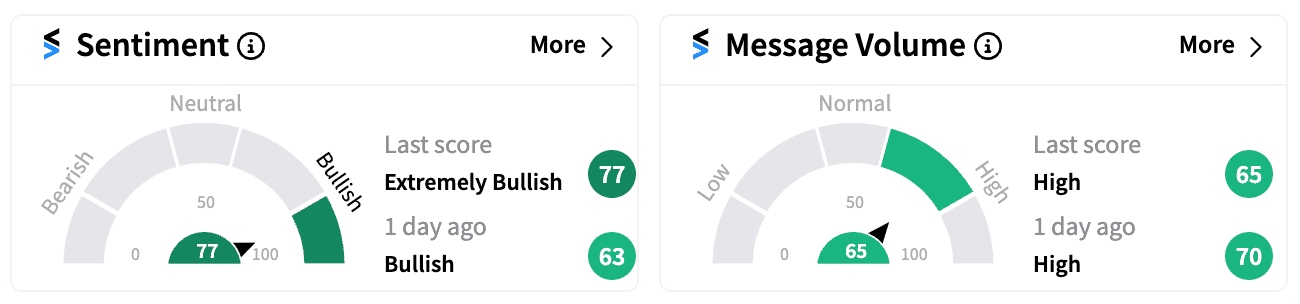

Intel Corp. (INTC): In stark contrast to Nvidia, Intel is mirroring the overall market negativity. Pre-market losses suggest it’s headed for its worst opening in over a decade, and retail sentiment reflects this pessimism. Stocktwits sentiment is ‘extremely bearish’ (10/100), reaching its lowest point in over a year.

Recent analyst downgrades from Bank of America and Baird, coupled with Intel's own weak financial forecasts, are contributing factors.

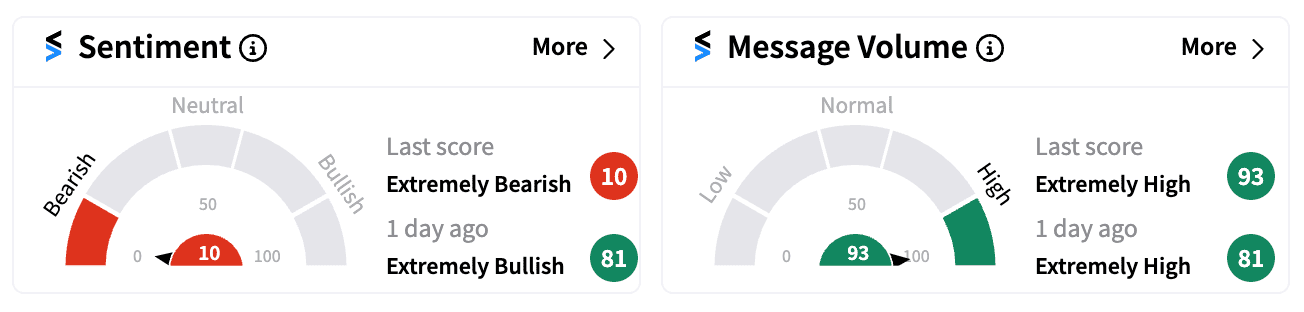

Apple, Inc. (AAPL): Apple's pre-market dip comes despite positive Q3 earnings reported last week. Retail sentiment on Stocktwits is currently ‘neutral’ (53/100), compared with bullish a day ago, indicating indecisiveness among investors.

Amid the market rout, Apple has regained its title as the world's most valuable company. However, the weekend news of Warren Buffett's Berkshire Hathaway cutting its Apple holdings in half is creating caution among investors, even as Wall Street analysts urge them to stay calm and look beyond this development, Bloomberg reported.

Photo courtesy: Nvidia

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_jpg_6c4cc95d17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Jumia_Image_02_a5a20c8bb3.png)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_bitfarms_logo_resized_f65def1bbc.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novo_nordisk_obesity_resized_8455e31e08.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2022/07/Nestle-Shutterstock.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)