Advertisement|Remove ads.

Pfizer Stock Falls As Former Execs Pull Back From Starboard’s Activist Campaign: Retail Still Sees Hope

Shares of Pfizer, Inc. ($PFE) dropped over 2% Thursday morning after two former top executives announced they would not support activist shareholder Starboard Value’s push for a company turnaround.

Former CEO Ian Read and former CFO Frank D’Amelio, in a joint statement, said, “We have decided not to be involved in the efforts of Starboard Value regarding Pfizer. We are fully supportive of Pfizer Chairman & CEO Albert Bourla, senior management and the board, and we are confident that over time they will deliver shareholder value.”

However, the situation took a dramatic turn as Starboard issued a letter to Pfizer’s board, alleging the company attempted to coerce Read and D’Amelio into backing Bourla.

The letter claimed that Pfizer, or its representatives, had threatened costly litigation, the clawback of prior compensation, and the cancellation of unvested stock units if the former executives did not publicly support the current leadership.

Starboard called the alleged actions a “significant breach of fiduciary duty” and requested that the board investigate.

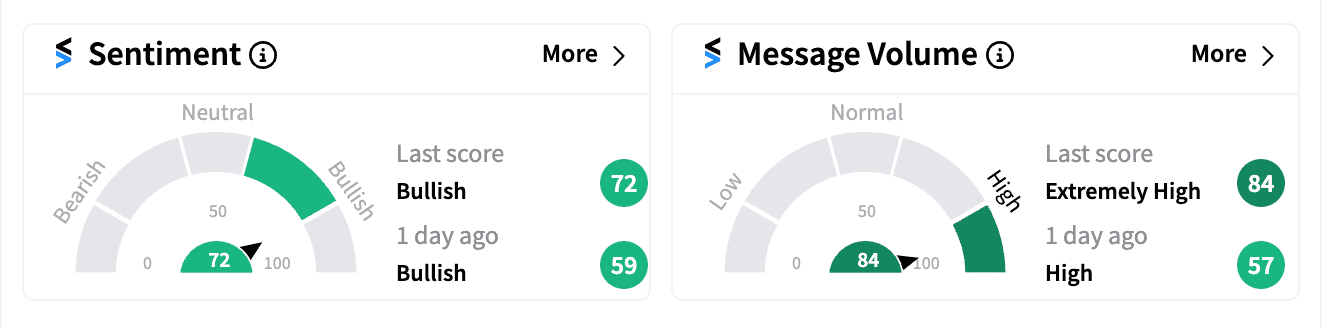

On Stocktwits, retail sentiment remained ‘bullish’ (72/100), with ‘extremely high’ message volume, as investors weighed the unfolding drama.

This development comes just days after reports that Bourla was set to meet with Starboard, which recently acquired a $1 billion stake in Pfizer.

Earlier in the week, The Wall Street Journal reported that Starboard had approached Read and D’Amelio to potentially lead a transformation effort at the company.

Pfizer’s stock surged during the pandemic, driven by its COVID-19 vaccine success, peaking at around $59 in late 2021. However, shares have since fallen by more than 50%, as pandemic-related revenues dwindled. Year-to-date, PFE is down 0.6%.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147678_jpg_9e7c3ea177.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_chart_rising_resized_6ebc3dd7e4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trading_Floor_jpg_8da7cb0a89.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/shanthi_v2_compressed_98c13b83cf.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bse_new_resized_jpg_a9ea3d5623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237197547_jpg_572177a331.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236205110_jpg_995291c2b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)