Advertisement|Remove ads.

Children’s Place Stock’s Retail Sentiment Crashes Amid Short Interest Surge And Post-Earnings Rally

Shares of Children’s Place Inc. (PLCE) soared in pre-market trading on Monday, pushing the stock to nearly four-month highs. This jump follows an eye-catching 28% gain on Friday, fueled by an unexpected second-quarter (Q2) profit.

The profit was largely driven by a sharp reduction in Selling, General, and Administrative (SG&A) expenses, which dropped to the lowest level in 15 years.

Still, the stock is still down 36% for the year.

Short interest, a measure of bearish sentiment, has spiked, reflecting growing concern among retail investors. According to Ortex data, short positions as a percentage of the company’s free float increased from 21.5% to 29.5% last week, reaching a four-month high.

Children’s Place has managed to pull itself back from the brink of bankruptcy earlier this year, thanks to backing from Saudi Arabia-based Mithaq Capital.

Despite these positive developments, the stock is starting to resemble a classic ‘meme stock’ — volatile and driven by speculative retail traders.

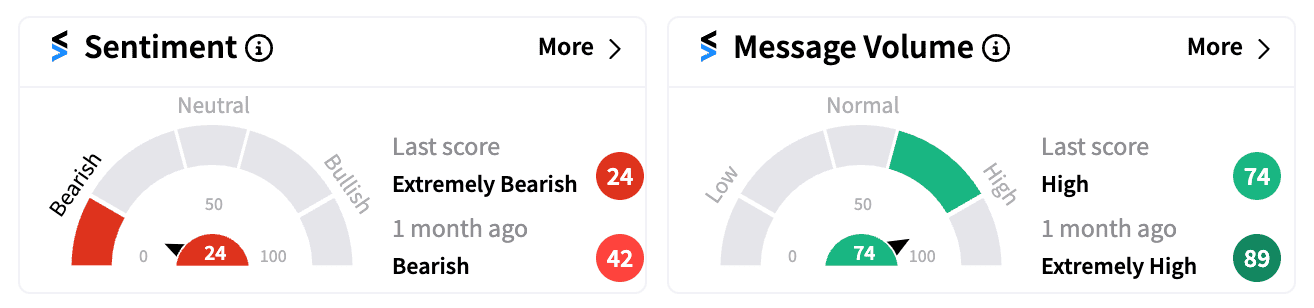

On Stocktwits, many retail investors have turned ‘extremely bearish’ (24/100) on PLCE, expressing skepticism over its sustainability post-earnings.

“Look for yourself at the charts. What happened last time it squeezed? This time RSI is much more overbought,” posted one user, forecasting a plunge back to $10.

Another user warned, “This is overdue for a major correction down to $4.”

PLCE’s Relative Strength Index (RSI), a key measure of whether a stock is overbought or oversold, currently stands at 84.40 — well into the overbought range and the highest reading for the stock this year.

Coupled with thin trading volumes — less than a tenth of its daily average — there’s an air of caution around the stock’s trajectory.

While the surge has certainly excited some bulls, it has also emboldened the bears. The coming days will be crucial in determining whether this is the beginning of a sustained comeback or just another brief spike before a sharp pullback.

Read next: Instil Bio Soars On Baird’s Price Target Boost: Retail Remains On Sidelines Amid Wild Surge

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stablecoin_rep_jpg_5ec196dfc2.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)