Advertisement|Remove ads.

Palantir Stock Defies Market Turmoil To Hit Over 3-Year Highs, Retail Excitement Runs High

Shares of Palantir Technologies Inc. (PLTR) rose more than 1% on Friday, to hit its highest intraday level since January 2021.

While broader markets, including the S&P 500, faced pressure from the ongoing conflict in the Middle East, Palantir continued to rally.

Palantir’s momentum surged this week amid two developments: a strategic partnership with Edgescale AI to launch Live Edge, a platform integrating AI into industrial environments; and an extension of its multi-year enterprise agreement with APA Corporation to incorporate Palantir’s advanced AI software, AIP, into APA’s operations.

A Barron’s report also revealed that Palantir Chairman and co-founder Peter Thiel sold 12.4 million shares, the maximum amount his latest trading plan allowed, netting $457.4 million between Sept. 27 and Oct. 1.

The sale, executed under a prearranged trading plan, now leaves Thiel’s Rivendell 7 LLC with over 34 million Palantir shares.

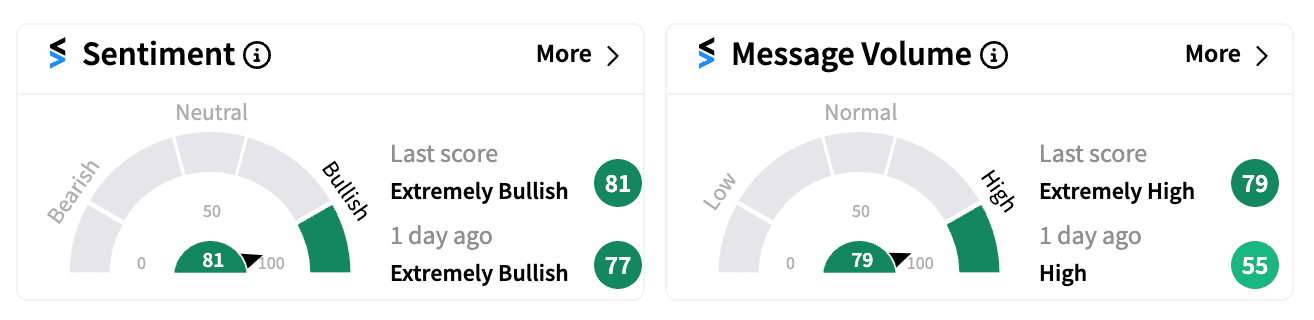

Retail sentiment on Stocktwits remains exuberant, with Palantir’s stock trending as ‘extremely bullish’ (81/100) as of 1:00 pm ET.

Palantir’s stock is up more than 140% year-to-date, fueled by strong demand for its AI-driven software and its recent inclusion in the S&P 500.

However, some analysts have cautioned that the stock may be overvalued, raising questions about the sustainability of the broader AI boom.

Despite some skepticism, Palantir’s data analytics tools, popular among government agencies and private clients alike, have solidified its position as a leader in the AI space.

With institutional ownership at 41.72% — led by Vanguard Group — interest in Palantir shows no signs of slowing.

Read next: SilverCrest’s Stock Shines On $1.7B Buyout Bid From Coeur Mining, Grabs Retail Attention

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1248428688_jpg_059f14eab1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200767431_jpg_a442265700.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crude_oil_shale_oil_field_resized_jpg_bfab720d5f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cars_dealership_jpg_ec0afa0631.webp)