Advertisement|Remove ads.

Rivian Stock Gets Another Price-Target Cut Ahead Of Q3 Earnings: Retail Worries Deepen

Shares of Rivian Automotive, Inc. ($RIVN) dropped over 8% on Wednesday, following a fresh price-target reduction ahead of the company’s third-quarter (Q3) earnings announcement, due on Thursday.

This week’s second cut came from Guggenheim analyst Ronald Jewsikow, who lowered the target from $21 to $18 while maintaining a ‘Buy’ rating.

Jewsikow noted that Rivian’s supplier issues, which have impacted production through Q3 and into Q4, are now weighing heavily on both Q3 and full-year estimates.

Earlier in the week, Mizuho analyst Vijay Rakesh had also reduced the brokerage’s target price on Rivian from $15 to $12 and reiterated a ‘Neutral’ rating.

Rakesh highlighted that demand for electric vehicles remains soft, especially in the U.S., which could hinder Rivian’s market performance.

Nonetheless, he pointed to Rivian’s promising product roadmap, including the lower-cost R2 vehicle slated for 2026, and its Volkswagen tie-up, which has bolstered its balance sheet and reduced liquidity concerns.

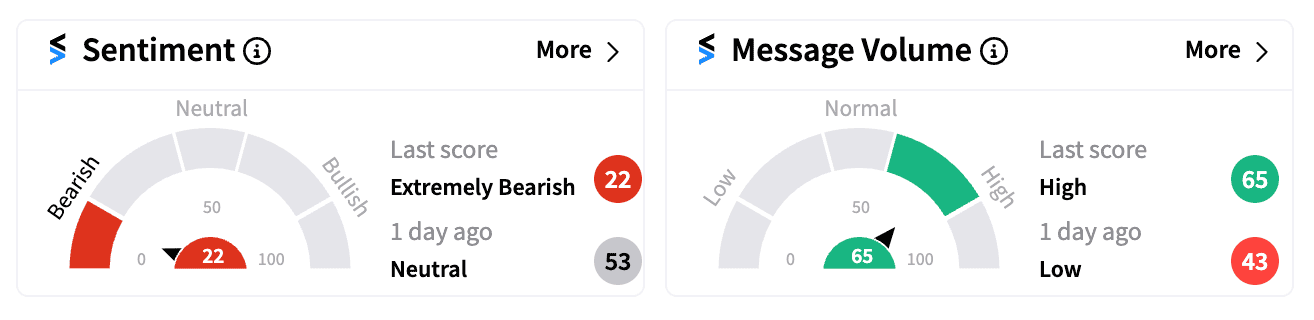

On Stocktwits, sentiment around Rivian plunged to ‘extremely bearish’ (22/100) late Wednesday morning from ‘neutral’ just a day prior.

Several retail investors have expressed concerns about Rivian’s ongoing financial struggles, recent production woes, and the potential impact of incoming U.S. President Donald Trump’s policies, which could result in cuts to EV credits.

Rivian’s stock has suffered a sharp decline since its record IPO in 2021, falling over 90% from peak levels due to persistent production challenges, steep costs, and mounting losses.

Looking toward Q3 earnings, Wall Street anticipates Rivian’s adjusted loss per share to narrow from $1.19 a year ago to $0.95, with revenue projected to dip to $1 billion from $1.34 billion.

Amid Trump’s recent election victory, several analysts suggested that EV tax credits could be at risk, but mostly for the smaller players.

Mamta Valechha, an analyst at Quilter Cheviot, reportedly noted, “This would be negative for the EV industry, but should give Tesla a clear competitive advantage because of its scale and vertical integration, giving it a cost advantage vs. legacy OEMs.”

Year-to-date, Rivian’s stock has plunged over 50%, contrasting with Tesla ($TSLA), which has managed to gain 14% in the same period.

For updates and corrections, email newsroom@stocktwits.com

Read next: US Election 2024: Trump's Triumph Lifts Bitcoin To Record High, Crypto-Linked Stocks Surge

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/07/hurricane-beryl-5-2024-07-6ad8c6db35be45b24fa8611eaa2023d3.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/10/flipkart-2025-10-500547a97cf8cecd9816497a91d3c2d0.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/02/aluminium.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2021/05/ONGC1.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/08/sbi-2024-08-3d512e93ea6e88c29c9d7f4713260a92.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/02/2024-02-23t024741z-1448558367-rc2ir5a9l3sm-rtrmadp-3-china-property-houseprices.jpg)