Advertisement|Remove ads.

Can Sona BLW Shares Rebound? SEBI Analyst Sees Upside If Breakout Sustains Above ₹430

Sona BLW shares have been in a downtrend, losing 10% in the last month. And technical charts now indicate an upside potential if the stock shows a sustained breakout.

Internal governance and legal family disputes that have surfaced after the sudden demise of the company's chairman and non-executive director, Sunjay Kapur, have sparked investor concerns and weighed on sentiment.

SEBI-registered analyst Krishna Pathak noted that Sona BLW is trading near key resistance levels. It is below the 9-week Exponential Moving Average (EMA) of ₹419, which is currently acting as resistance.

Pathak said that the stock is trading in a consolidation range, facing strong resistance near ₹430 and finding strong support around ₹400.

Add-on Accumulation Opportunity

The ₹370–₹380 zone, where historical buying interest has been observed, offers a favorable risk–reward entry point, according to him. Since Sona BLW is near a significant support level, a potential trend reversal is likely, shifting from a short-term downtrend to a fresh upward momentum.

Pathak added that a sustained breakout above ₹430 can pave the way for the ₹519–₹576 levels in the short term. And a decisive breakdown below ₹300 may trigger further downside. He advised maintaining a strict stop-loss discipline.

Target prices have been identified at ₹519, ₹576, and ₹612.

What Is The Retail Mood?

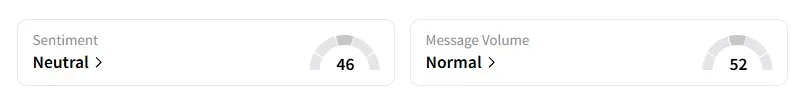

Data on Stocktwits shows that retail sentiment moved to ‘neutral’ a day ago. It was ‘bearish’ last week.

Sona BLW shares have declined 32% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_warner_bros_discovery_wbd_resized_jpg_bae2c7edb6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)