Advertisement|Remove ads.

STMicroelectronics Stock Falls On Bernstein Downgrade, Analysts Say ‘No Clear Bottom In Sight’: Retail Sentiment Declines

Shares of STMicroelectronics NV (STM) fell over 1% in mid-day trade on Wednesday after analysts at Bernstein downgraded the stock and cut their price targets due to a “weak” first-quarter guidance from the company.

According to TheFly, Bernstein analyst Sara Russo downgraded the STMicroelectronics stock to ‘Market Perform’ from ‘Outperform,’ citing visibility concerns due to a lack of formal guidance for the fiscal year 2025.

According to Russo, this leaves investors with a challenging view for the year ahead, with “no clear bottom in sight.”

The brokerage also cut the price target for STM stock from $33 to $26, with the implied upside reducing from nearly 49% to a little over 15% from current levels.

No guidance for 2025 has also pushed the brokerage to “considerably” revise its estimates lower.

Bernstein’s downgrade comes after analysts at Baird, JPMorgan, TD Cowen, and Susquehanna reduced their price targets for the STM stock, with growth headwinds and guidance concerns finding a mention.

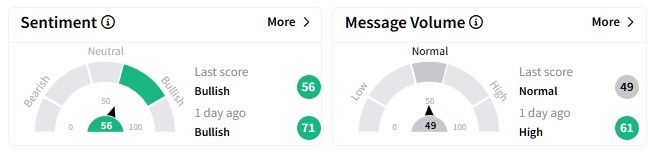

Retail sentiment on Stocktwits around the STMicroelectronics stock worsened on Wednesday, hovering in the ‘bullish’ (56/100) territory but declining from (71/100) a day ago.

Message volume also declined, dipping to ‘neutral’ (49/100) from the ‘high’ (61/100) levels a day ago.

One user analyzed the put versus call contract position for the STM stock as of Monday, noting that the shares are “going down” over the short and medium terms.

STM’s stock price has declined nearly 25% over the past six months, while its one-year performance is worse, with a fall of over 50%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es8_jpg_6097d170b7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_76024286_jpg_1a0537b0fc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Weave_jpg_a4b797d3d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Zscaler_jpg_c6a5978bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)