Advertisement|Remove ads.

Swan Energy Could Rally Toward ₹800 Again, Says SEBI RA Mayank Singh Chandel

Swan Energy shares have rallied 6% on Tuesday and are among the top trending stocks on Stocktwits.

The company announced that it had formed a special purpose vehicle (SPV) along with Balu Forge to explore defence and nuclear capabilities. Swan will own 60% stake in this newly formed unit, making it their subsidiary.

SEBI-registered analyst Mayank Singh Chandel flagged that Swan Energy stock had a significant uptrend from early 2023, reaching almost ₹800 by the end of 2024.

After this peak, it went through a correction and has been steady since early 2025. He adds that the stock is trading in a tight range between ₹350 and ₹500. Swan Energy is on the analyst’s radar now because the current move indicates that the underlying trend remains intact, with solid support near ₹350.

Its Relative Strength Index (RSI) is at 58.32, which shows room for growth. Chandel called this a “base-building phase,” which often precedes a strong upmove.

He noted that a close above ₹500 could lead to a fresh rally for Swan Energy. If that happens, it could potentially set the stage for an upmove towards its previous high near ₹800 and beyond.

What’s Driving This Bullishness?

Chandel believes that long consolidation often lead to strong breakouts. According to him, the stock’s RSI has stayed between 30 and 70, showing balanced sentiment, which is neither too extremely overbought nor oversold conditions. And a breakout above ₹500 with volumes would be a strong bullish indicator.

The previous uptrend shows the stock’s ability to rally when momentum builds, he added.

According to Chandel, the stock is in a classic accumulation range, where smart investors buy ahead of a big breakout. The longer Swan Energy stays in this range, the bigger the move when it breaks out.

He advises investors to wait for confirmation, a close above ₹500 with volume support, before taking action. Until then, he asked them to remain disciplined and add the stock to the watchlist.

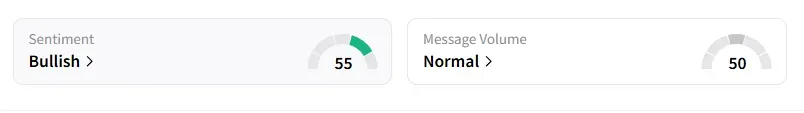

Data on Stocktwits shows that retail sentiment is ‘bullish’ on this counter.

Swan Energy shares have fallen 37% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)