Advertisement|Remove ads.

Diwali 2025 Stock Picks: Swiggy, Sagility Poised For 25%–30% Upside, Says SEBI Analyst Financial Independence

As Diwali lights up Dalal Street, SEBI-registered analyst Financial Independence has spotlighted Swiggy and Sagility as their festive stock picks. They believe that both stocks showed early signs of a trend reversal and offered up to 30% potential upside in the short to medium term.

Let’s take a look at the rationale behind their Diwali stock picks for 2025:

Diwali Pick: Swiggy

Financial Independence shared a short to medium-term call on Swiggy, which is in a range-bound consolidation after trend reversal

On the technicals, they noted that after listing highs near ₹617, Swiggy underwent a steep correction, bottoming around ₹300. Since May 2025, the stock has shown signs of trend reversal, forming higher lows and stabilizing above ₹400. The price action now indicates base formation between ₹390 and ₹460, which is a typical accumulation range before a potential breakout. Additionally, the volume build-up on upward candles suggests institutional interest returning at lower levels.

According to Financial Independence, the stock is currently holding near the short-term support zone around ₹410. A breakout above ₹475–480 could confirm a trend reversal. They identified targets at ₹510 and ₹550–560, indicating a 30% potential gain from the current price. On the downside, ₹385 acts as a strong stop-loss zone.

The analysts advised accumulating Swiggy stock in a SIP mode near ₹410–₹420 with stop loss below ₹385 for 2–4 months.

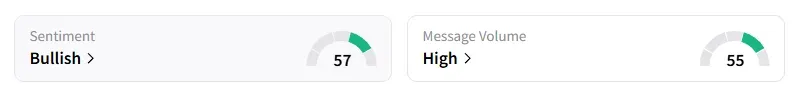

Data on Stocktwits shows that retail sentiment has moved from ‘neutral’ to ‘bullish’ a day ago.

Swiggy shares are down 19% year-to-date (YTD)

Diwali Pick: Sagility

The analyst shared a swing to medium-term setup in Sagility.

On the technical side, the stock has witnessed a sharp initial rally post-listing, hitting highs near ₹65 before entering a broad corrective consolidation. Indicators show early signs of strength, but are still below breakout confirmation. Additionally, volume activity has contracted, suggesting accumulation by smart money.

Financial Independence noted that Sagility stock is currently taking support near ₹41.70, which aligns with the 50% retracement zone. A breakout above ₹52 could confirm a fresh uptrend.

They have pegged targets at ₹55 and ₹60, offering around 25–30% potential gains from current levels. On the downside, ₹38.20 acts as a strong stop-loss zone. The analysts also advised medium-term investors that it is a perfect SIP-style setup, recommending ‘accumulate’.

Financial Independence cautioned that a close below ₹38 may extend the correction toward ₹33. More importantly, volume confirmation and closing above ₹50 are essential for trend confirmation.

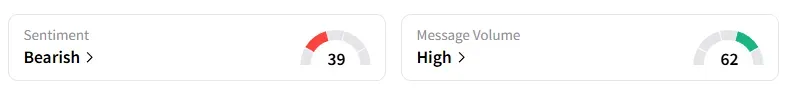

Data on Stocktwits shows that retail sentiment has moved from ‘extremely bearish’ to ‘bearish’ a day ago.

Sagility shares are down 9% year-to-date (YTD)

Disclaimer: The views and opinions expressed are those of the SEBI-registered analyst/advisor mentioned in the article, and are not endorsed by Stocktwits. This is not investment advice. Please do your own research or consult a financial advisor.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)