Advertisement|Remove ads.

Synopsys-Ansys’ $35B Deal Reportedly Gets China’s Conditional Approval Days Before Closure Deadline

China's antitrust authority has greenlit Synopsys Inc.(SNPS)'s $35 billion acquisition of engineering software firm Ansys Inc. (ANSS), clearing the final international hurdle for the deal between two key players in the electronic design automation (EDA) industry.

According to a Reuters report, the conditional approval from the State Administration for Market Regulation (SAMR) came just days ahead of the deal’s July 15 closure deadline.

Following the news, Synopsys stock traded 3.3% higher in Monday’s premarket session.

While regulatory bodies in other key global markets had already approved the transaction, doubts lingered over whether Chinese authorities would delay the deal due to ongoing political and trade friction.

Investor anxiety grew after the United States imposed limits on the export of specific semiconductor design technologies to China, prompting speculation that Beijing might respond with its countermeasures.

Synopsys had suspended its services in China in June after U.S. export controls compelled the company to stop sales and support operations. It also paused its financial forecasts for both the third quarter and the fiscal year 2025.

The approval arrives just weeks after President Donald Trump’s administration lifted restrictions on exports of critical semiconductor design tools to China.

The ban, introduced in May, had impacted not only Chinese customers but also employees of foreign firms operating within China. Its lifting paved the way for the long-pending deal to resume progress, stated a report from SCMP.

China's approval was granted under a set of obligations. The merged company is expected to provide Chinese customers with continued, unbiased access to electronic design automation tools.

Additionally, the firms must honor all existing agreements, renew interoperability partnerships upon request, and preserve their current contractual commitments in the Chinese market.

The deal is expected to bolster Synopsys’ position against rival Cadence, broadening its product suite and deepening its foothold in the EDA sector.

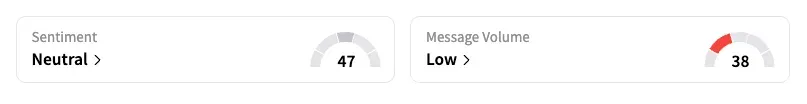

On Stocktwits, retail sentiment toward Synopsys shifted to ‘neutral’ from ‘bearish’ territory the previous day amid ‘low’ message volume levels.

Synopsys stock has gained over 15% year-to-date and has lost over 9% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)