Advertisement|Remove ads.

Tata Steel Shines As Q2 Output Gains Impress; Analyst Sees Stock Heading To ₹185

Tata Steel shares rose over 2% on Thursday after the steelmaker reported a 7% rise in crude steel production for Q2FY26, an indicator of operational recovery and volume stability. Crude steel production reached 5.67 million tonnes in India, an 8% rise compared to the previous quarter. Deliveries within India stood at 5.56 million tonnes, up 7% (YoY).

Operations in the Netherlands remained stable at 1.67 million tonnes, while the UK business continued its transition to electric arc furnace (EAF) technology at Port Talbot. For the first half of FY26, Tata Steel’s total crude steel production reached 10.9 million tonnes, a minor 3% rise (YoY). Domestic demand continued to support Tata Steel’s output.

Bullish Bet On Tata Steel

SEBI-registered investment advisor Nidhi Saxena of The Trade Bond is bullish on Tata Steel. She added that its recent completion of blast furnace relining at Jamshedpur is expected to support smoother production operations.

Saxena highlighted a significant development from the European steel market, with the proposed safeguard measures likely to benefit Tata Steel’s European operations.

Among positives, she noted Tata Steel’s consistent volume growth and a growing contribution from high-margin, value-added steel. However, challenges remain in the form of steel price cyclicality, global overcapacity issues leading to cheap imports, volatility in input costs, and margin pressures in European operations.

Trading Call

Saxena identified a potential target of ₹185 in the near term for Tata Steel.

What Is The Retail Mood?

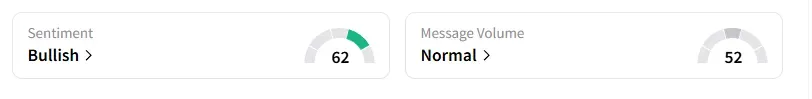

Data on Stocktwits shows that retail sentiment improved to ‘bullish’ from ‘neutral’ last week.

Tata Steel shares have risen 27% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)