Advertisement|Remove ads.

Tesla Q3 Earnings: Here’s What Gary Black, Seth Goldstein, Troy Teslike Think Of The Upcoming Results

- The Elon Musk-led EV giant is expected to report an EPS of $0.55 on revenue of $26.54 billion, according to Stocktwits data.

- This would mark a return to growth for the company, after it reported two consecutive quarters of year-on-year declines in the first half of fiscal year 2025.

- The Future Fund LLC’s Managing Partner, Gary Black, expects Tesla CEO Elon Musk to be more optimistic on the timing of Robotaxis and their efficacy.

Tesla Inc. (TSLA) is all set to announce its third-quarter results after the closing bell on Wednesday.

The EV giant is expected to report earnings per share (EPS) of $0.55 on revenue of $26.54 billion, according to Stocktwits data. This would mark a return to growth for the company, after it reported two consecutive quarters of year-on-year declines in the first half of fiscal year 2025.

Ahead of the Q3 results, Tesla shares were down 1.7% in Wednesday’s midday trade. Retail sentiment on Stocktwits around the company trended in the ‘extremely bearish’ territory at the time of writing.

Here’s What Experts Are Saying

In an early October update, Tesla reported 497,099 deliveries in the third quarter, its best quarter yet. According to some analysts, this could boost Tesla’s Q3 performance, helping the company to potentially beat Wall Street expectations.

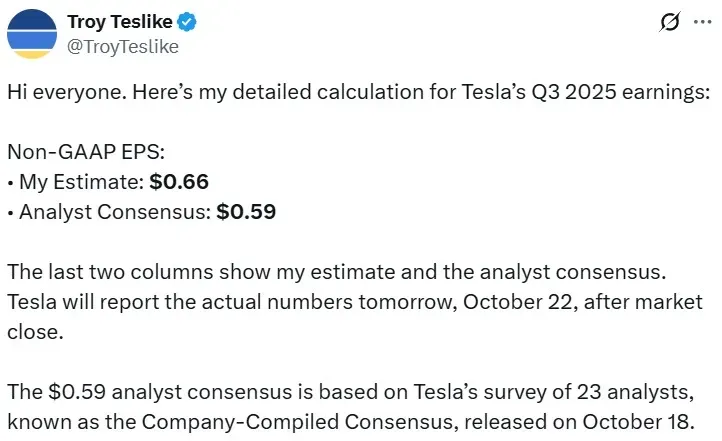

Tesla researcher Troy Teslike said in a post on X that he expects the company to report an EPS of $0.66 on revenue of $28.4 billion. He also added in another post that he expects operating expenses to remain constant from the second quarter (Q2), noting that they were higher than usual during the April to June period.

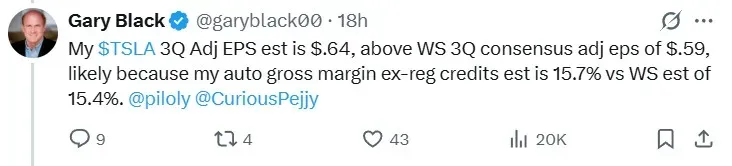

The Future Fund LLC’s Managing Partner, Gary Black, said in a post on X that he expects Tesla to post an EPS of $0.64 in Q3, once again above analyst estimates, according to Stocktwits data. In another post, Black sounded optimistic about Musk’s commentary.

“I expect a $TSLA 3Q beat today (WS non-GAAP EPS $.59, my est $.64) and Elon being even more optimistic than usual in his commentary on Robotaxi timing and efficacy given the pending shareholder vote on his comp plan at the Annual Meeting on Nov 6, the outcome which was never in doubt (70-75% approval expected).”

— Gary Black, Managing Partner, The Future Fund LLC

However, not everyone is sold on the bull thesis.

Seth Goldstein Says Current Stock Price Assumes Unrealistic Growth

Morningstar’s senior equity analyst, Seth Goldstein, stated in a CNBC interview that the markets have gotten too carried away with enthusiasm for Tesla’s Robotaxi plans. Goldstein has a ‘Sell’ rating on the TSLA stock, with a price target of $250. This implies a downside of 43% from the current Tesla share price, which was hovering near $433 at the time of writing.

“We’re skeptical that we’ll see a full launch next year, meaning the Robotaxi will be launched without safety drivers in the car, and when/without any parameters or geofencing in the areas where they operate,” Goldstein said during the interview.

He added that the full Robotaxi launch is still a few years away, and noted that the markets are pricing in Tesla surpassing Alphabet Inc.’s Waymo, and beginning to take some market share from Uber Technologies Inc. and Lyft Inc. in the ride-hailing segment.

Goldstein also stated in the interview that if there are any safety incidents involving the company’s Robotaxis, a lot of optimism in the Tesla stock would “quickly disappear.”

TSLA stock is up 8% year-to-date and 99% in the past 12 months.

Get updates to this story developing directly on Stocktwits.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)