Advertisement|Remove ads.

Tesla Stock Climbs As Robotaxi Event Looms: Retail Investors Cheerful While Wall Street Remains Divided

Tesla’s (TSLA) stock has lost over 11% year-to-date, dragged by back-to-back earnings misses and worries about thinning margins amid an EV market slowdown. Even as Wall Street is deeply concerned about the company’s future, retail investors are relatively calm and optimistic.

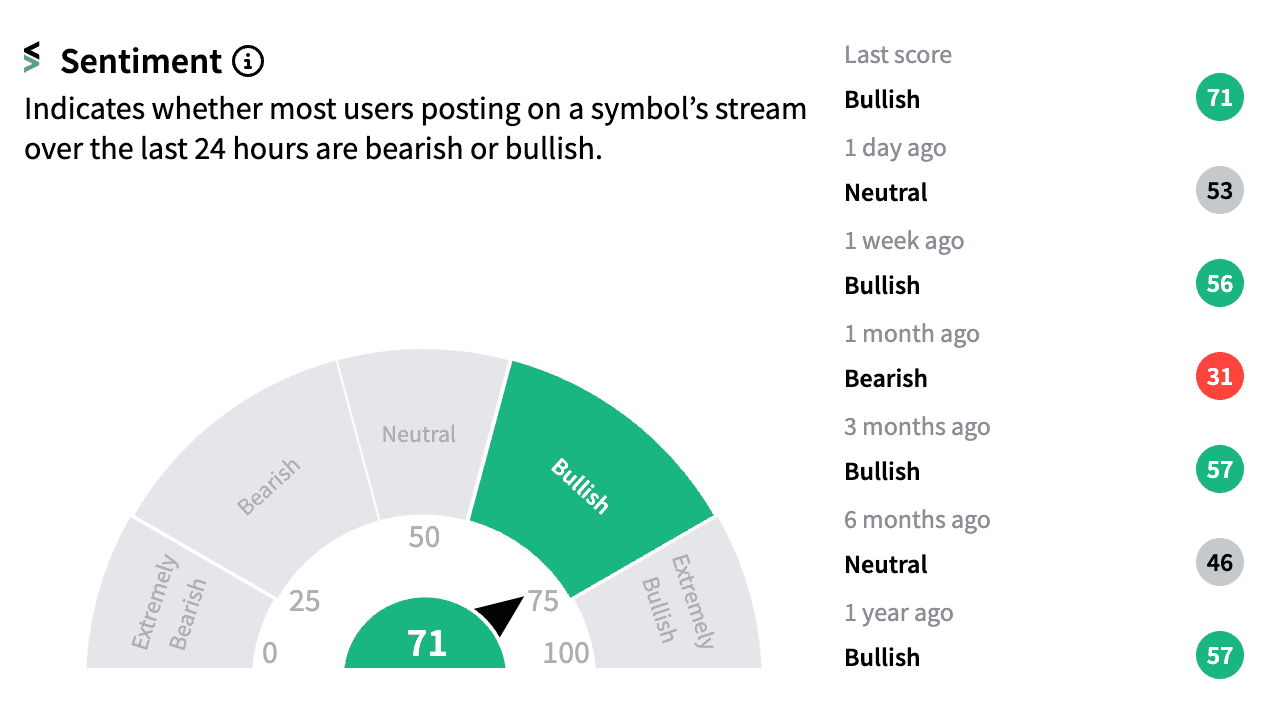

On Stocktwits, Tesla’s nearly million-strong retail following is currently ‘bullish’, with sentiment score (71/100) reaching its highest point in over two months. This is considerably higher versus where it was at the beginning of the year.

The unveiling of Tesla's robotaxi prototype on Oct. 10 is a key driver of excitement. While this event has been rescheduled from its originally planned Aug. 08 date and details remain scarce, CEO Elon Musk has reportedly teased the reveal of "a couple of other things" alongside the robotaxi.

The robotaxi, and its associated "unsupervised" full self-driving (FSD) software, are viewed as central to Tesla's future profitability.

Analyst opinions on Tesla are split. Piper Sandler recommends owning Tesla shares leading up to the robotaxi event, citing “rising profits from Tesla's large stationary batteries and apparent improvements to its full self-driving software.”

The brokerage has an ‘Overweight’ rating on Tesla shares with a $300 price target, which represents a 36% upside from current levels.

However, Truist remains cautious, maintaining a ‘Hold’ rating after a recent FSD test resulted in two "fast fails" and highlighted limitations.

The brokerage doubts FSD v12.5 is close to achieving true autonomy or robotaxi capabilities, and says it remains "befuddled" as to what Tesla might introduce in its planned robotaxi event in October.

Despite these concerns, many analysts believe successful implementation of FSD could unlock significant revenue streams, particularly if deployed commercially in China.

While Wall Street analysts debate on, Tesla's dedicated retail investor base remains a source of strong support for the company. The stock has gained over 11% over the past five days.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2179601835_jpg_034e692fb1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_canopy_growth_weed_resized_6896927dba.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_f_150_lightning_jpg_311100907b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_stock_jpg_1a4860daf4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nasdaq_original_jpg_ad4cc4a377.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1945576902_jpg_e7dd5c5f55.webp)