Advertisement|Remove ads.

Toll Brothers Stock In Focus After Q4 Earnings Beat: Retail’s Bullish

Shares of luxury home builder Toll Brothers Inc. ($TOL) were down nearly 5% on Tuesday afternoon after having risen earlier following the firm’s fourth-quarter earnings that beat analyst estimates, lifting retail sentiment on the stock.

Earnings per share stood at $4.63, beating the estimated $4.34 quoted by Wall Street analysts.

Revenues came in at $3.33 billion, above the $3.17 consensus estimate, according to Stocktwits data.

Home sales revenues were $3.26 billion, up 10% compared to last year; delivered homes were 3,431, up 25%.

For the full year, net income was $1.57 billion, and diluted EPS stood at $15.01, compared to net income of $1.37 billion and EPS of $12.36 per share last year.

“Our performance this year and in the fourth quarter demonstrates the power of our luxury brand, the financial strength of our buyers, and the success of our strategies of increasing our spec home production and widening our geographies, price points, and product lines,” Douglas C. Yearley Jr., chairman and CEO, said in a statement.

“Since the start of our fiscal 2025 six weeks ago, we have seen strong demand, which is encouraging as we approach the beginning of the spring selling season in mid-January. We are well positioned with communities in over 60 markets across 24 states featuring the widest offering of luxury homes and serving the most affluent customers in our industry.”

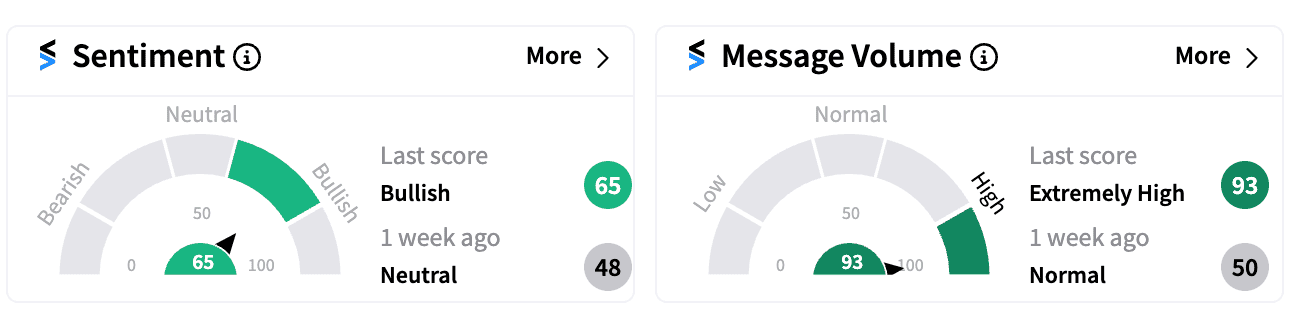

Retail sentiment on the stock improved to ‘bullish’ (65/100) from ‘neutral’ (48/100) a week ago. Message volumes climbed to the ‘extremely high’ zone from ‘normal.’

In the fourth quarter of FY 2024, Toll Brothers spent about $258.6 million on land to purchase approximately 1,910 lots.

Fort Washington, Pa-based Toll Brothers stock is up 46% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)