Advertisement|Remove ads.

Top Tesla Bull Retreats With 42% Price-Target Cut Amid Trump's Tariff 'Armageddon' — Retail Feels Stock Not Even Close To Bottom

Shares of Tesla, Inc. shed more than 9% last week, their worst five-day performance in a month, amid a broader market crash sparked by President Donald Trump's trade war.

Retail investor confidence also took a hit, while one of the most bullish analysts on the EV giant grew even more uneasy.

Wedbush analysts led by Daniel Ives cut their price target on Tesla's stock to $315 from $550, saying the "economic tariff Armageddon unleashed by the Trump Administration is a double whammy for Tesla."

The research firm noted that while Tesla is less exposed to tariffs than legacy automakers like GM, Ford, and Stellantis, it still relies heavily on imported parts and batteries, making it vulnerable to rising costs.

"The bigger worry in our opinion is Tesla's success in China," Ives wrote, calling the Asian country a "linchpin" to the company's future success.

He added that the backlash from Trump's tariff policies in China and Musk's association with the U.S. president will be hard to understate, further driving Chinese consumers to buy domestic brands such as BYD, Nio, and Xpeng.

"The 1Q delivery number was a disaster," the analysts said, adding that 2025–2026 could be brutal if CEO Elon Musk doesn't "exit stage left or take a step back on DOGE" soon.

With tariffs, retaliation, and uncertainty from China, they said revised estimates are now a "moving target."

While maintaining an 'Outperform' rating on Tesla, Wedbush said, "this is a pivotal moment of truth for Musk to turn things around… or darker days are ahead."

"Musk has been with his back against the wall many times… this may be one of his biggest challenges yet."

Wedbush conservatively estimates that Tesla may have “lost or destroyed at least 10% of its future customer base globally” due to these brand issues.

“In Europe, this number could be 20% or higher… all self-inflicted by Musk,” he added.

On Stocktwits, retail conversations about Tesla rose slightly over the last week while sentiment dipped within the ‘bullish’ territory.

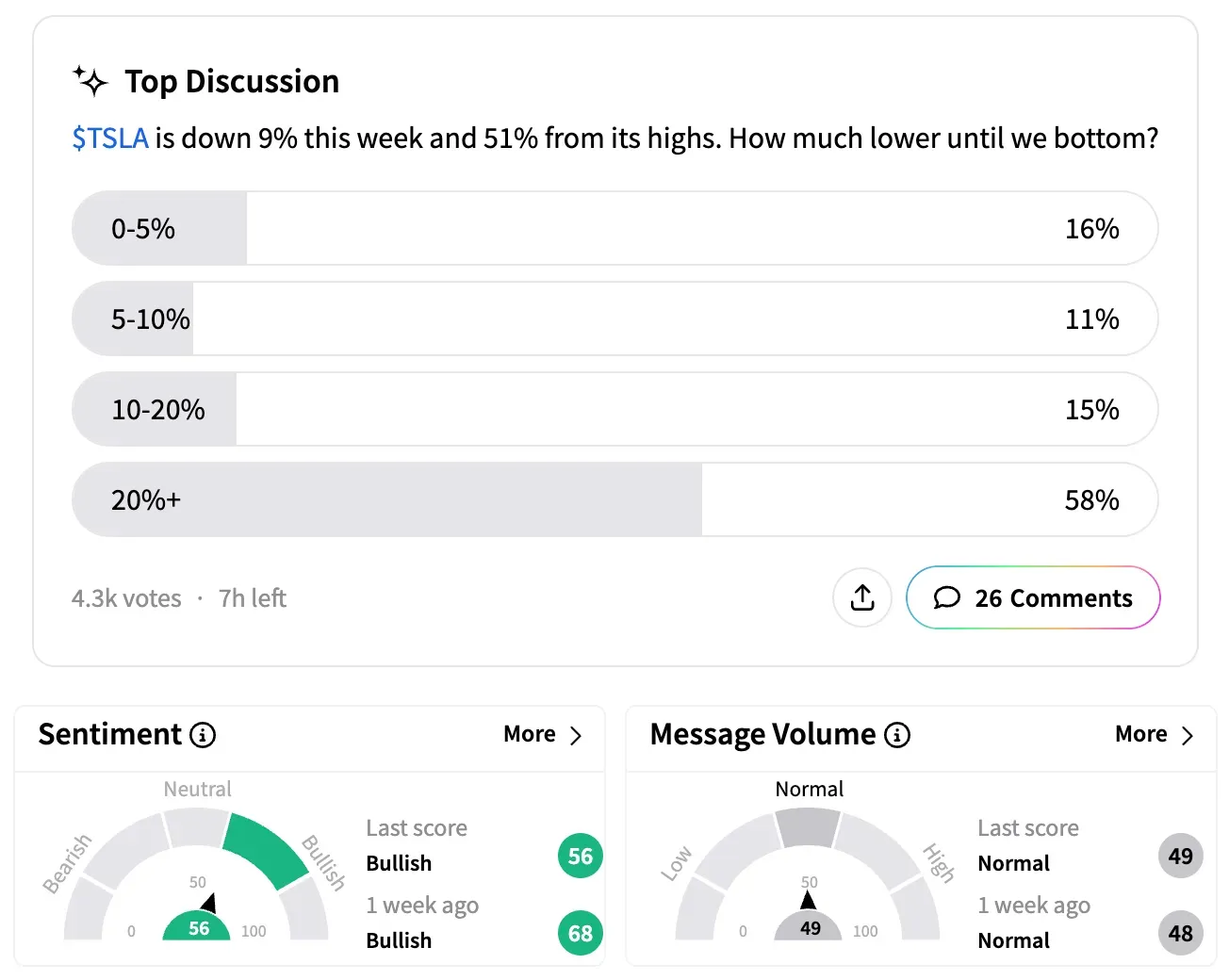

An ongoing poll on the platform showed that 58% of over 4,300 respondents expect the stock to plunge another 20% before bottoming.

Meanwhile, 16% anticipate only a 0%–5% drop, 15% see a 10%–20% decline, and 11% expect a 5%–10% fall.

"Markets are going to continue to crash Monday to match a depression to the likes you've never seen since 1929," said one user. "Brand is tarnished, the rest of the world doesn't want to be seen in a Tesla, and China is far ahead in electric vehicles and FSD/AI."

“Tesla is not even close to the bottom yet. Once it gets down to the 12 month low we can start talking about where the bottom is,” said another skeptic, who expects it to fall “for the next several months.”

Tesla stock now trades at more than a 35% discount to the average price target of 48 analysts covering it on Wall Street, according to Koyfin.

Shares of the company have lost more than 38% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)