Advertisement|Remove ads.

TSMC H1 Revenue Surges 40% Despite June Dip: Retail Stays Confident

Taiwan Semiconductor Manufacturing Co. (TSMC) (TSM) , the leading contract chipmaker, released its June 2025 revenue figures on Thursday.

The semiconductor giant reported NT$263.71 billion ($9 billion) in revenue for June, reflecting a 17.7% decline from May 2025 but a 26.9% year-over-year (YoY) increase.

Following the news, Taiwan Semiconductor stock traded 1.3% lower in morning trading on Thursday.

The latest monthly results suggest a degree of volatility amid broader demand trends in the chip sector.

For the first half of 2025 , TSMC reported consolidated revenue of NT$1.773 trillion ($60.6 billion), marking a 40% YoY increase. The year-to-date growth suggests continued momentum in areas such as AI accelerators and high-performance computing.

Despite the overall growth, the sequential decline in June revenue could raise questions about near-term demand dynamics or supply chain fluctuations.

In June, TSMC CEO CC Wei noted that tariffs implemented under U.S. President Donald Trump could drive up expenses for TSMC’s Arizona plant, where the company is committing $165 billion in investment.

TSMC has found itself caught in the crossfire of escalating geopolitical strains between the U.S. and Taiwan. President Donald Trump criticized Taiwan for not having a formal defense agreement, despite the country's reliance on American military support.

Trump also proposed ending federal subsidies for semiconductor manufacturers like TSMC, questioning the rationale behind funding their U.S.-based fabrication facilities aimed at strengthening domestic chip production.

For the second-quarter (Q2) of 2025, TSMC anticipates revenue of $28.4 billion to $29.2 billion.

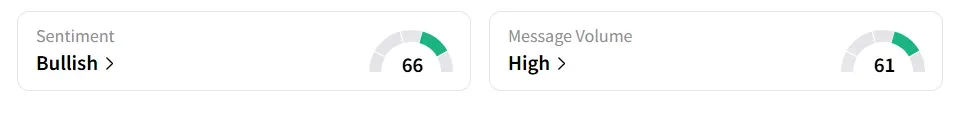

On Stocktwits, retail sentiment toward Taiwan Semiconductor remained in ‘bullish’ territory amid ‘high’ levels of message volume.

Taiwan Semiconductor stock gained over 16% year-to-date and over 20% in the last 12 months.

Exchange Rate: 1NT = 0.034USD

Also See: BIT Mining Stock More Than Doubles On $300M Solana Treasury Plan

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)